Insurance organizations rarely struggle because of a lack of technology. More often, they struggle because technology operates in silos. Claims, policy, and billing systems typically evolve independently as each department optimizes its own workflows, metrics, and tools. As a result, insurers create fragmented operations that limit visibility, slow decision making, and increase operating effort. However, that model no longer scales. As […]

Underwriting in an Orchestrated AI Environment: From Risk Assessment to Real-Time Decisions

Underwriting has always been the foundation of insurance performance. Pricing accuracy, portfolio quality, and long term profitability depend on how effectively underwriters assess risk and make decisions. Yet for many insurers, underwriting technology continues to lag behind claims. Increasingly, claims teams are leveraging AI-driven workflows and automation, while underwriting teams are still relying on static rules, fragmented data, and manual decision making. However, that dynamic is rapidly changing. […]

Beyond Automation: What Agentic AI Means for Claims Adjusters and Supervisors

The End Goal is Better Claims Outcomes, Not Just automation for its Own Sake. For years, claims automation has been framed as a cost-reduction exercise: automate tasks, reduce headcount, move faster. That framing has created understandable resistance among adjusters and supervisors who worry that AI is designed to replace judgment rather than support it. Agentic AI changes […]

How AI Orchestration Is Redefining Modern Claims Management Software

For years, innovation in claims technology focused on automation. Faster workflows. Fewer manual steps. More tasks handled by machines. That wave delivered real efficiency gains, but it also created a new problem for claims leaders: disconnected automation that is difficult to govern, explain, and scale. As claims organizations look ahead, the conversation is shifting. The question is […]

Human-in-the-Loop Is Not Optional: Designing Oversight into Agentic AI Systems

Why Human Oversight Is Becoming a Strategic Requirement in Insurance Agentic AI is transforming how insurers operate. Unlike traditional automation, Agentic AI systems can reason, plan, and execute actions across workflows. In claims, underwriting, and risk operations, this capability is accelerating decisions and improving outcomes. But with greater autonomy comes greater responsibility. For insurance organizations, human-in-the-loop […]

The Rise of Agentic Workflows: How AI Is Learning to Manage Insurance Processes

For years, Artificial Intelligence in insurance has been framed around automation; automating a task, accelerating a step, or reducing manual effort in a specific function. While automation delivered early wins, it also created a fragmented landscape of point solutions that operate in isolation. As insurers move into 2026, a new shift is underway. AI is no longer just executing tasks, it […]

From Point Solutions to Platforms: Why Disconnected AI Is Holding Insurers Back

Artificial Intelligence is no longer judged by novelty or isolated wins. The conversation has shifted toward how AI operates across the enterprise, how it supports decision-making at scale, and how multiple AI models work together inside core systems. Yet many insurance organizations are finding themselves stuck in an uncomfortable middle ground. They have invested in AI, but […]

Why AI Orchestration Is Becoming the New Operating Model for Insurance

As organizations begin to navigate 2026, Artificial Intelligence is no longer evaluated by novelty or isolated use cases. The conversation has shifted toward how AI operates inside the enterprise, how it supports decision-making at scale, and how multiple AI models work together responsibly across core systems. This shift is giving rise to a new insurance operating model: AI […]

Agentic AI in Insurance: From Automation to Orchestration

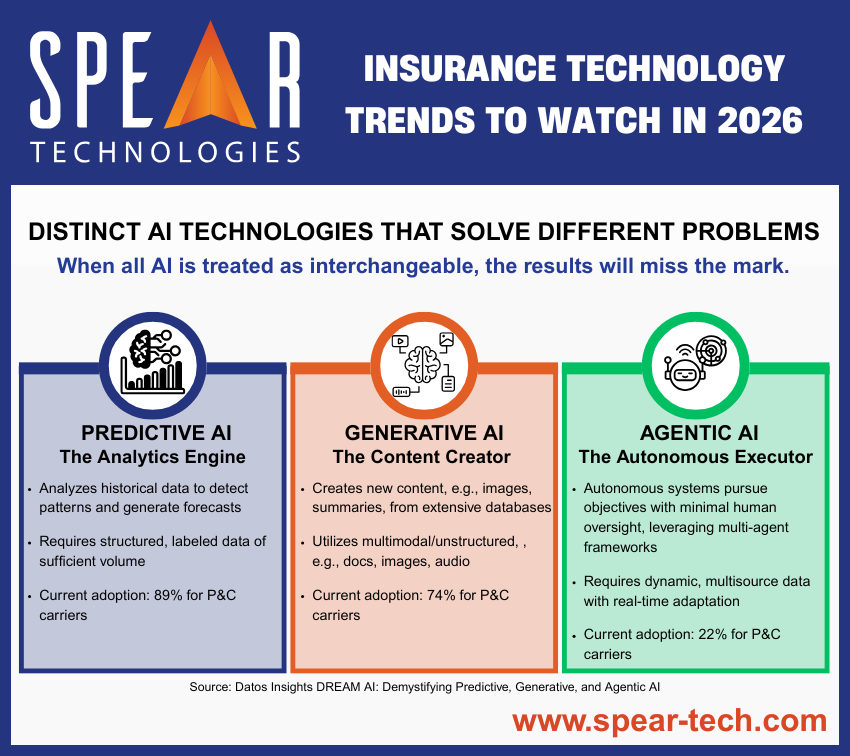

As insurers prepare for 2026, Artificial Intelligence is entering a new phase. The conversation is no longer about whether AI can generate content or predict outcomes, it’s about how AI can coordinate work, manage complexity, and drive outcomes across systems. This shift is being driven by a rapidly emerging capability known as Agentic AI. Unlike traditional AI tools that respond […]

Insurance Technology Trends to Watch in 2026: From AI Capabilities to AI Orchestration

As the insurance industry looks toward 2026, technology conversations are shifting from whether to adopt AI to how to operationalize it responsibly, effectively, and at scale. Artificial Intelligence is no longer a novelty or a single feature: it is becoming a foundational layer of the best claims management software. The best P&C core systems now feature AI models embedded as a standard […]