For years, innovation in claims technology focused on automation. Faster workflows. Fewer manual steps. More tasks handled by machines. That wave delivered real efficiency gains, but it also created a new problem for claims leaders: disconnected automation that is difficult to govern, explain, and scale. As claims organizations look ahead, the conversation is shifting. The question is […]

Human-in-the-Loop Is Not Optional: Designing Oversight into Agentic AI Systems

Why Human Oversight Is Becoming a Strategic Requirement in Insurance Agentic AI is transforming how insurers operate. Unlike traditional automation, Agentic AI systems can reason, plan, and execute actions across workflows. In claims, underwriting, and risk operations, this capability is accelerating decisions and improving outcomes. But with greater autonomy comes greater responsibility. For insurance organizations, human-in-the-loop […]

The Rise of Agentic Workflows: How AI Is Learning to Manage Insurance Processes

For years, Artificial Intelligence in insurance has been framed around automation; automating a task, accelerating a step, or reducing manual effort in a specific function. While automation delivered early wins, it also created a fragmented landscape of point solutions that operate in isolation. As insurers move into 2026, a new shift is underway. AI is no longer just executing tasks, it […]

From Point Solutions to Platforms: Why Disconnected AI Is Holding Insurers Back

Artificial Intelligence is no longer judged by novelty or isolated wins. The conversation has shifted toward how AI operates across the enterprise, how it supports decision-making at scale, and how multiple AI models work together inside core systems. Yet many insurance organizations are finding themselves stuck in an uncomfortable middle ground. They have invested in AI, but […]

Why AI Orchestration Is Becoming the New Operating Model for Insurance

As organizations begin to navigate 2026, Artificial Intelligence is no longer evaluated by novelty or isolated use cases. The conversation has shifted toward how AI operates inside the enterprise, how it supports decision-making at scale, and how multiple AI models work together responsibly across core systems. This shift is giving rise to a new insurance operating model: AI […]

Agentic AI in Insurance: From Automation to Orchestration

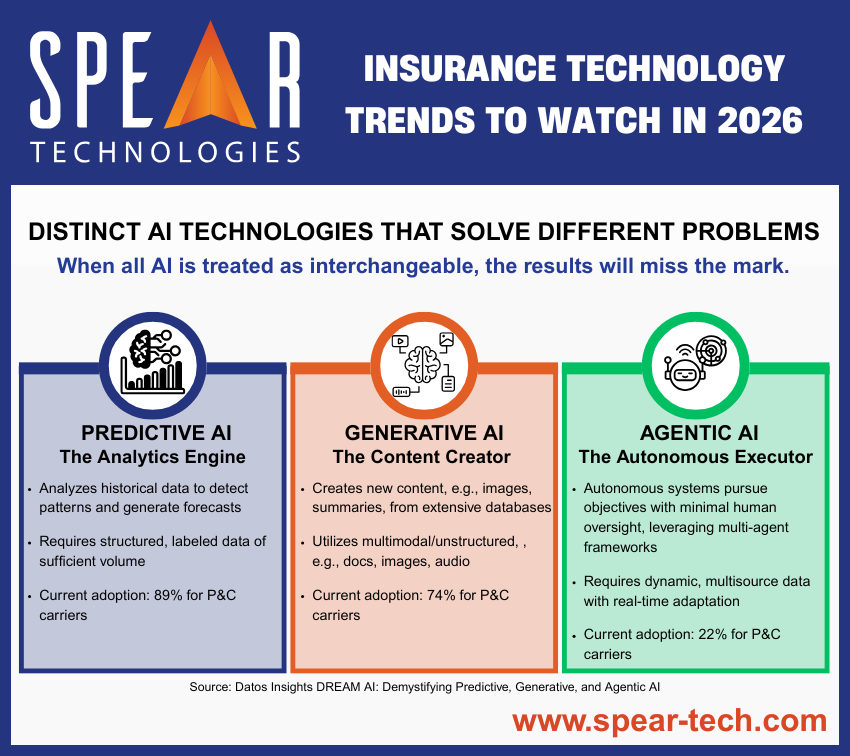

As insurers prepare for 2026, Artificial Intelligence is entering a new phase. The conversation is no longer about whether AI can generate content or predict outcomes, it’s about how AI can coordinate work, manage complexity, and drive outcomes across systems. This shift is being driven by a rapidly emerging capability known as Agentic AI. Unlike traditional AI tools that respond […]

Insurance Technology Trends to Watch in 2026: From AI Capabilities to AI Orchestration

As the insurance industry looks toward 2026, technology conversations are shifting from whether to adopt AI to how to operationalize it responsibly, effectively, and at scale. Artificial Intelligence is no longer a novelty or a single feature: it is becoming a foundational layer of the best claims management software. The best P&C core systems now feature AI models embedded as a standard […]

Accessible AI for Risk Managers: Future-Proofing Risk Management with AI-Driven Oversight

The role of the modern risk manager is evolving rapidly. Rising claim complexity, increasing litigation exposure, shifting environmental and regulatory conditions, and the constant pressure to prevent losses place intense demands on already limited teams. Traditional approaches to risk oversight can no longer scale to meet these requirements. The next generation of risk excellence depends […]

Accessible AI for Pool Administrators: Future-Proofing Pool Administration with AI-Driven Transparency

Public entities face increasing pressure to deliver high-quality services with limited budgets, expanding compliance requirements, and rising claim complexity. At the same time, administrators must balance stewardship, transparency, and service expectations while ensuring that every dollar is used responsibly. In this environment, Accessible AI for Public Entities gives leaders a practical way to strengthen oversight, […]

Accessible AI for Operations Leaders: Future-Proofing Insurance Operations: Embedding AI Into Long-Term Strategy

Insurance operations leaders are under constant pressure to deliver faster service, improve accuracy, and maintain impeccable compliance while managing rising claim volumes and increasingly complex workflows. Traditional operational improvements such as process redesign or staffing adjustments can offer only limited gains. The future of operational performance lies in technology that amplifies the output of every […]