For Pool Administrators, few responsibilities are more important—or more complex—than ensuring vendors and TPAs deliver consistent, high-quality service. Settlement delays, litigation rates, and inconsistent communication all have downstream impacts on member satisfaction and financial performance. Yet traditional oversight methods often rely on lagging indicators, anecdotal feedback, or manual audits that only reveal problems after the […]

Accessible AI for Risk Managers: Improving Oversight and Vendor Accountability with AI

For Risk Managers, ensuring strong oversight and accountability across vendors, third-party administrators (TPAs), and claims operations is a constant challenge. With multiple entities handling claims, even small gaps in communication or performance tracking can lead to costly delays, inconsistent settlements, or compliance risks. Accessible AI offers a solution. By surfacing real-time performance data and standardizing […]

Accessible AI for Operations Leaders: AI-Powered Consistency: Eliminating Workflow Bottlenecks Across Teams and Vendors

In property and casualty insurance, operational consistency is the foundation of efficiency, compliance, and customer trust. Yet for many operations leaders, achieving that consistency across multiple teams, vendors, and systems remains one of the biggest challenges. From claims administration to vendor coordination, each process introduces the risk of delays, miscommunication, and non-standard execution. These inconsistencies […]

Accessible AI for IT Leaders: Scaling Secure Vendor Interactions with Virtual Agents

For IT leaders in insurance, the stakes have never been higher. Legacy claims systems, siloed data flows, and fragmented vendor ecosystems stretch resources thin. Each new integration, partner portal, or third-party connection creates another dependency to maintain—while business users continue to request faster data access, automation, and transparency. In our last article, Accessible AI for […]

Accessible AI for Claims Leaders: AI-Powered Oversight: Improving Accountability and Performance

For claims executives, oversight is not just about monitoring, it’s about accountability, transparency, and measurable performance. Whether managing in-house adjusters or outsourced vendors, leaders need timely insights into performance trends, compliance gaps, and escalation risks. Without these, costs climb, litigation rises, and stakeholders lose trust. In our last article, Accessible AI for Claims Leaders: Stopping […]

Accessible AI for Pool Administrators: High-Risk Claim Identification – Stopping Escalations Before They Become Losses

For Pool Administrators, few challenges weigh more heavily than managing high-risk claims. These claims—whether they involve litigation, rising medical costs, or prolonged recovery times—can destabilize budgets, erode member confidence, and undermine the stability of the pool itself. The problem is that traditional oversight methods often reveal risks only after reserves have already spiked, leaving little […]

Accessible AI for Risk Managers: High-Risk Claim Identification – Stopping Escalations Before They Become Losses

For Risk Managers, few challenges carry more weight than high-risk claims. These are the cases that quietly build pressure—headed toward litigation, mounting medical costs, or prolonged resolution delays—until they suddenly erupt into major financial losses. Traditional oversight methods often leave Risk Managers reacting after reserves spike, rather than intervening early. And make no mistake—the stakes […]

Accessible AI for Operations Leaders: Proactive High-Risk Claim Management – Reducing Downstream Costs Through Early Intervention

For Operations Leaders in insurance, few challenges are more disruptive than high-risk claims. These claims often escalate into litigation, excessive medical costs, or lengthy disputes—driving up expenses and straining resources. Claims leaders often recognize problems too late to prevent significant downstream costs. And make no mistake—the stakes are high. Consider the costs of high-risk […]

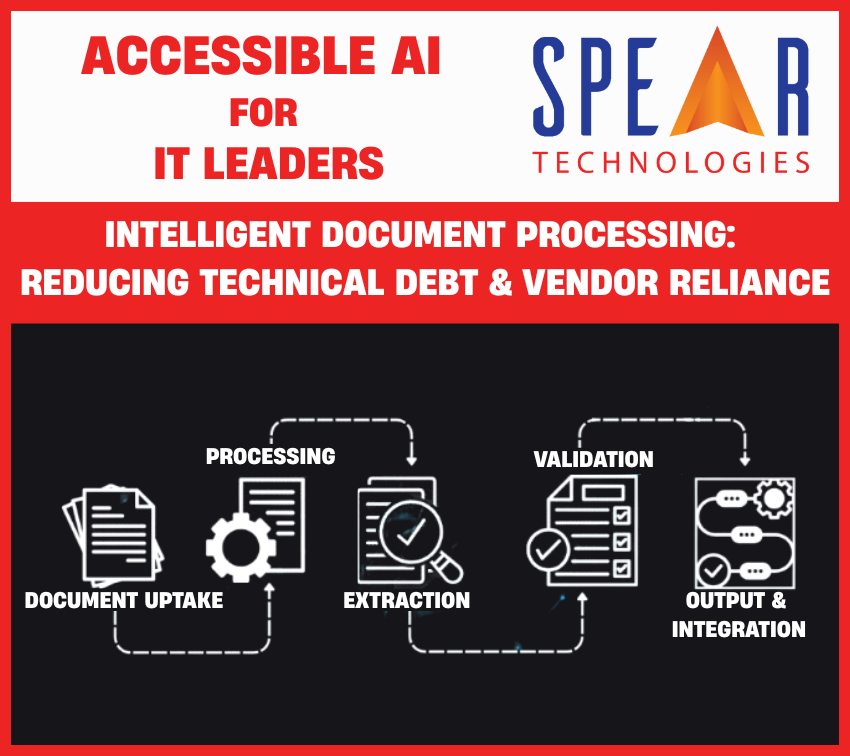

Accessible AI for IT Leaders: Intelligent Document Processing – Reducing Technical Debt and Vendor Reliance

For IT leaders in insurance, the stakes have never been higher. Legacy claims systems, siloed data flows, and brittle point solutions force teams into a constant cycle of patching and maintaining rather than innovating. At the same time, the volume and complexity of documents—from First Notice of Loss (FNOL) submissions to medical bills and vendor […]

Accessible AI for Claims Leaders: Stopping Costly Claims Before They Escalate

For claims executives, controlling costs and reducing litigation often comes down to one critical factor: how early you identify and manage high-risk claims. Left unchecked, these claims spiral quickly, driving up severity, prolonging resolution, and consuming disproportionate resources. And make no mistake – the stakes are high. Consider the costs of high-risk claims by […]