Your Core Platform is Not as Secure or Scalable as You Think

Part 2 in the Series “6 Essential Characteristics of a Core Insurance Platform in 2024“

AFLAC, Geico, Zurich and Gallagher all have made news recently for the wrong reasons: data breaches. Too often, companies operate with blinders on when it comes to technology, trusting that what they don’t know won’t hurt them. Those large, respected insurers assumed they were too big to have that happen to them, however, that assumption can be dangerously misguided. And costly! At the heart of any business is a software solution that supports daily operations and customers. If that critical system lacks modern security or the scalability to meet growth, the consequences of a breach or failure could be severe. For insurers, the right technology foundation is critical for both operations and building trust with customers.

It is crucial for insurance organizations, regardless of size, to ensure their core software has both robust security and flexibility to scale. A modern, secure, and adaptable platform should have these key attributes:

Too often, companies operate with blinders on when it comes to technology, trusting that what they don’t know won’t hurt them.

- Enterprise-Grade Security

While it might not be the sexiest topic, ensuring robust security is vital for any business. To stay protected, it is crucial to comprehend what security entails in your specific context. Your core software should meet and surpass your security needs. Companies of all sizes should adopt a layered defense strategy secured through cloud-based software built with security in mind. This goes beyond bare minimum compliance to industry standards like SOC2. True security requires incorporating best practices at all levels – from authentication mechanisms to data transmission protocols, storage protections to access controls. It starts with securing hardware infrastructure and extends throughout the technology stack up to the user interface. The goal is to safeguard your organization and customers from the constantly shifting cyber threat landscape. - Trusted Cloud

The move to cloud-based systems has transformed business operations. However, cloud solutions vary drastically in security and scalability. Organizations must rigorously validate that critical systems run on infrastructures with robust security and reliability. An enterprise-grade cloud delivers complete integrity, ironclad data protections, stays ahead of compliance needs, and gets backed by specialized support teams. - Dynamic Demand-Based Scaling

The ability to flexibly scale technology is crucial for business growth, and something that many insurers overlook. Systems should dynamically align to fluctuating needs – both spikes in short-term usage and exponential long-term expansion. Demand-driven scaling allows infrastructure to instantly match workload. This guarantees optimal speed during traffic surges while minimizing costs during slower periods. Rather than over-provisioning resources based on peak demand, capacity adjusts fluidly based on real usage patterns. This balances performance and expenditure, stretching budgets strategically. The ideal is full alignment between technology investment and shifting business requirements over time. Agile scalability future-proofs for the enterprise and removes limitations on innovation.

As insurance organizations invest in their technological future, the assurance of secure and scalable solutions cannot be overstated. It’s not just about embracing technology; it’s about investing in a solution that safeguards your operations and empowers your growth. Secure and scalable offerings from premier software vendors are not just tools; they are strategic assets that fortify your business against threats and propel it toward sustained success.

As you explore the possibilities, consider how prioritizing security, leveraging trusted cloud infrastructure, and embracing dynamic scalability can elevate your business to new heights of success and innovation.

At Spear Technologies (www.spear-tech.com), we deliver enterprise-class insurance software solutions which are built to provide industry-leading protection. With our solutions, your business benefits from the multi-billion-dollar investments and a long track record of security for billions of computers and zettabytes of data which are entrusted to Microsoft’s protection – paired with our experience and management oversight.

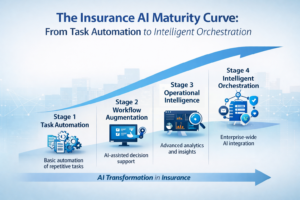

The Insurance AI Maturity Curve: From Task Automation to Intelligent Orchestration

Artificial intelligence has moved quickly from experimentation to strategic priority in the insurance industry. Many insurers are now investing in AI to improve underwriting, claims processing,

Breaking the Silos: How Orchestrated AI Connects Claims, Policy, and Billing

Insurance organizations rarely struggle because of a lack of technology. More often, they struggle because technology operates in silos. Claims, policy, and billing systems typically evolve independently as each

Underwriting in an Orchestrated AI Environment: From Risk Assessment to Real-Time Decisions

Underwriting has always been the foundation of insurance performance. Pricing accuracy, portfolio quality, and long term profitability depend on how effectively underwriters assess risk and make decisions. Yet for many insurers, underwriting technology

Beyond Automation: What Agentic AI Means for Claims Adjusters and Supervisors

The End Goal is Better Claims Outcomes, Not Just automation for its Own Sake. For years, claims automation has been framed as a cost-reduction exercise: automate

How AI Orchestration Is Redefining Modern Claims Management Software

For years, innovation in claims technology focused on automation. Faster workflows. Fewer manual steps. More tasks handled by machines. That wave delivered real efficiency gains, but it

Human-in-the-Loop Is Not Optional: Designing Oversight into Agentic AI Systems

Why Human Oversight Is Becoming a Strategic Requirement in Insurance Agentic AI is transforming how insurers operate. Unlike traditional automation, Agentic AI systems can reason, plan,