In today’s evolving insurance landscape, selecting the right Claims Management Software is critical to operational success, customer satisfaction, and long-term profitability. As public entities, TPAs, risk pools, and insurers face increasing demands for efficiency, transparency, and risk mitigation, investing in the optimal Claims Management Solution becomes a key strategic priority. Why Choosing the Right Claims […]

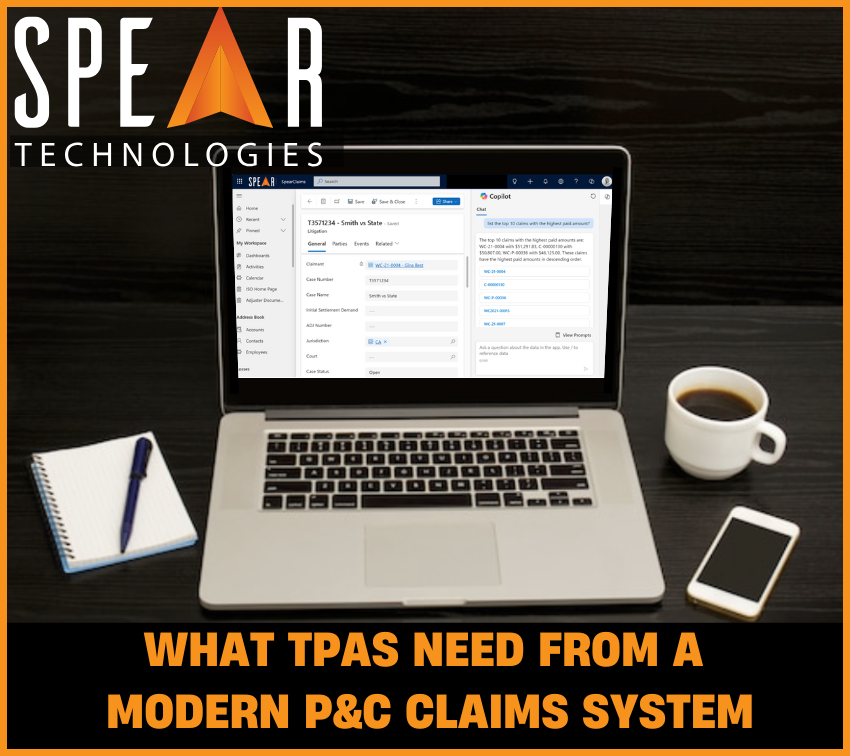

What TPAs Need from a Modern P&C Claims System: Flexibility, Intelligence, and Seamless Integration

Third Party Administrators (TPAs) are the operational backbone for many insurers, self-insured organizations, and public entities. Tasked with handling high volumes of claims across diverse clients – each with unique requirements – TPAs require more than just functional claims management software. They need modern Third-Party Administrator software that is agile, intelligent, and built for scale. […]

What Public Entities & Risk Pools Need from Their TPA’s Claims System: Visibility, Control, and Results

When organizations partner with Third Party Administrators (TPAs) to manage Property & Casualty claims, they expect more than just processing support—they expect strategic value, transparency, and outcomes that align with their goals. However, the effectiveness of a TPA relationship hinges on the capabilities of their claims management software. If the system lacks visibility, flexibility, or […]

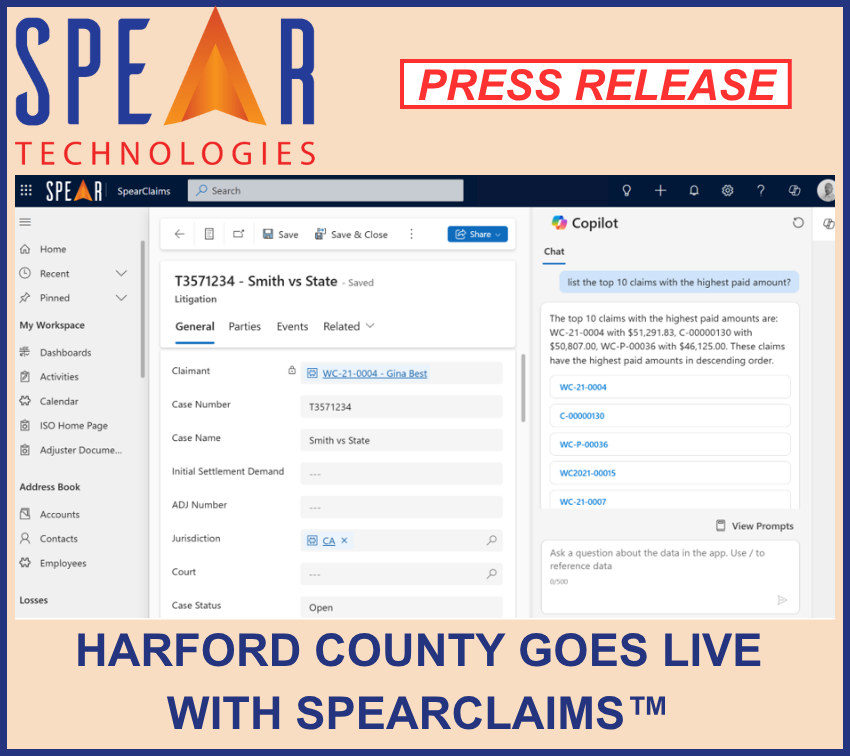

Harford County Has Gone Live with SpearClaims™ as Their New Claims Management Solution

Spear’s Claims Management Software Optimizes Claims Processing for Faster Response Times, Enhanced Data Security, Reduced Administrative Burden & Increased Operational Efficiency June 10, 2025 DENVER, CO – Spear Technologies (“Spear”), a leading provider of property and casualty insurance software solutions, is excited to announce that Harford County has gone live with SpearClaims™, as part of […]

Accessible AI for Insurers

As the insurance industry evolves, so too must its approach to artificial intelligence. While AI has long promised transformative potential, the real opportunity lies in making it accessible – turning complex technologies into user-friendly, integrative tools that empower business users, not just data scientists. To truly harness the power of AI, insurance organizations can now […]

What to Look for in a Claims Management System

A Buyer’s Guide for Carriers, TPAs, Public Entities, Risk Pools, and Self-Insureds As insurance organizations evolve, so do their expectations for technology. Legacy claims management software systems often fail to meet today’s need for automation, visibility, and speed. Whether you’re a carrier looking to modernize, a TPA serving multiple clients, a public entity managing complex […]

AI, Low-Code Platforms, and Customer-Managed Core Systems

How AI, Low-Code, and Customer-Managed Core Systems Are Transforming P&C Insurance The P&C insurance industry is evolving. Technology is changing how carriers manage policies, assess risk, and handle claims. AI, low-code platforms, and customer-managed core systems are driving this shift. These innovations improve efficiency and cut costs. They also give insurers more control and flexibility […]

Transforming Insurance with Low-Code/No-Code Platforms

As the insurance industry races toward digital transformation, carriers, TPA’s, MGAs and public entities are under pressure to modernize their core systems. Traditional software development can be time-consuming, expensive, and difficult to scale. Enter low-code/no-code insurance platforms: flexible, efficient, and cost-effective solutions that empower insurers to build and deploy applications faster than ever before. In […]

Enabling Self-Service Portals with Customer-Managed Solutions

In today’s digital-first landscape, customers expect convenience, speed, and control. In the insurance industry, delivering on these expectations is no longer optional—it’s essential. Self-service portals powered by customer-managed solutions are rapidly becoming a strategic priority for insurers seeking to meet rising customer demands while improving operational efficiency and reducing service costs. This article explores how […]

AI & Analytics for Insurance

How AI-Powered Insights Are Reshaping the Future of Insurance AI & analytics for insurance are no longer future trends—they are essential tools for insurers looking to compete and grow in today’s data-driven market. As carriers face pressure to lower costs, streamline operations, and deliver better policyholder experiences, artificial intelligence (AI) and advanced analytics provide the […]