In a rapidly changing insurance market, TPAs are expected to drive efficiency, transparency, and results—despite leaner teams and tighter timelines. Clients demand faster turnaround times, real-time visibility, and airtight compliance. But traditional claims handling processes, dependent on manual steps and IT intervention, can’t keep up. That’s where modern TPA Claims Management Software steps in—delivering automation […]

Choosing the Right Claims System for TPA Claims Management Oversight

Public entities and risk pools rely heavily on Third-Party Administrators (TPAs) to manage claims efficiently. But as expectations rise around transparency, compliance, and responsiveness, it is no longer enough to simply outsource claims handling. TPA claims management oversight, access, and collaboration are now just as critical to a successful program as claims resolution itself. That […]

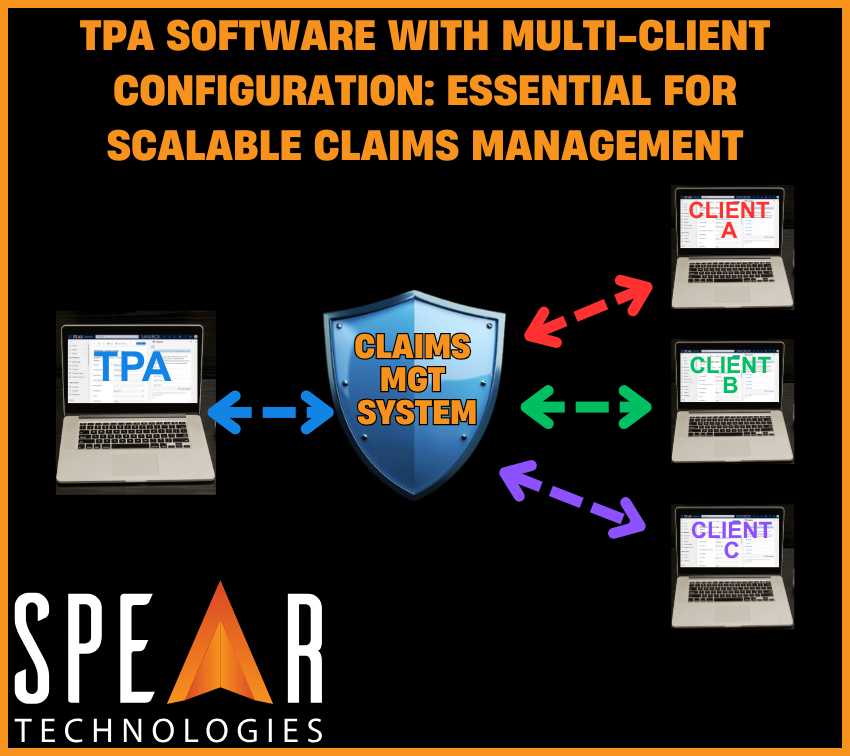

TPA Software with Multi-Client Configuration: Essential for Scalable Claims Management

In today’s competitive and compliance-driven environment, Third-Party Administrators (TPAs) must operate with increasing agility, precision, and transparency. As explored in our previous post, The Oversight Imperative: Why Public Entities Demand More Visibility Into Claims, public agencies and self-insured groups are demanding deeper insight into claims activity. But behind the scenes, a more foundational capability is […]

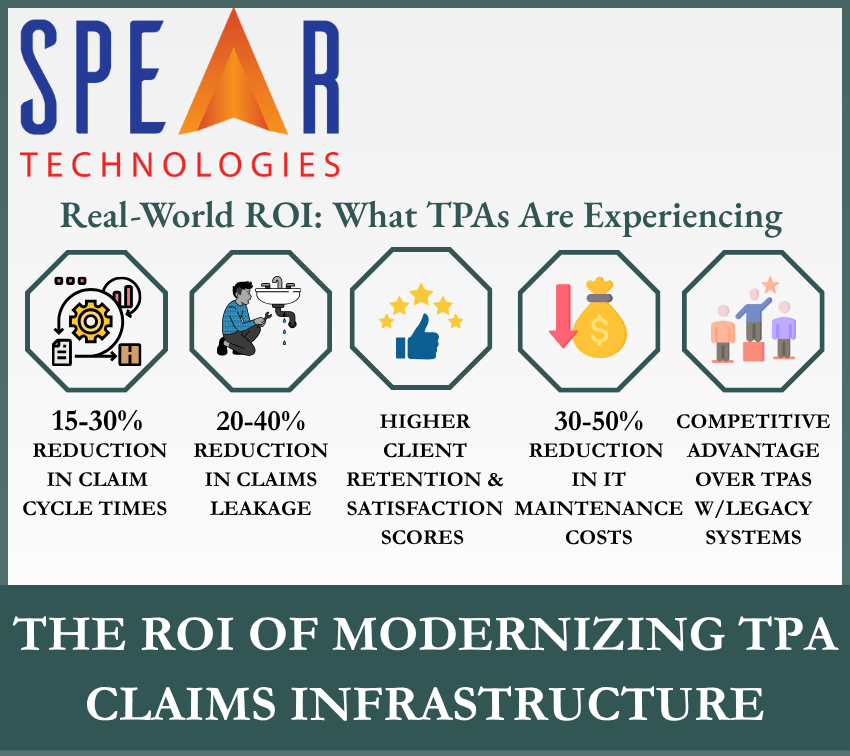

The ROI of Modernizing TPA Claims Infrastructure

Third-Party Administrators (TPAs) are under increasing pressure to deliver faster, more accurate, and more cost-effective claims handling services to their insurer, self-insured, and public entity clients. However, many TPAs are still operating on aging claims management solutions – Third-Party Administrator Software that limits their efficiency, inflates costs, and exposes them to operational risks like claims […]

Why More Organizations Are Implementing Their Own Claims Management Systems – Even When Using a TPA

Outsourcing claims administration to a Third-Party Administrator (TPA) has long been a practical strategy for Public Entities & Risk Pools looking to reduce operational overhead. But as expectations for transparency, speed, and cost control increase, highlighting the need for better claims management oversight, more risk managers and claims leaders are rethinking the technology behind those […]

How Modern Claims Systems Help TPAs Deliver More Value

Third-Party Administrators (TPAs) are under growing pressure to do more than simply process claims—they’re expected to deliver measurable value to clients. Whether working with insurers, self-insured employers, or public entities, TPAs must demonstrate transparency, responsiveness, and cost efficiency. The right claims management software can be the difference between meeting client expectations and exceeding them. As […]

Evaluating Claims Management Software: A Guide for Insurance Organizations

In today’s evolving insurance landscape, selecting the right Claims Management Software is critical to operational success, customer satisfaction, and long-term profitability. As public entities, TPAs, risk pools, and insurers face increasing demands for efficiency, transparency, and risk mitigation, investing in the optimal Claims Management Solution becomes a key strategic priority. Why Choosing the Right Claims […]

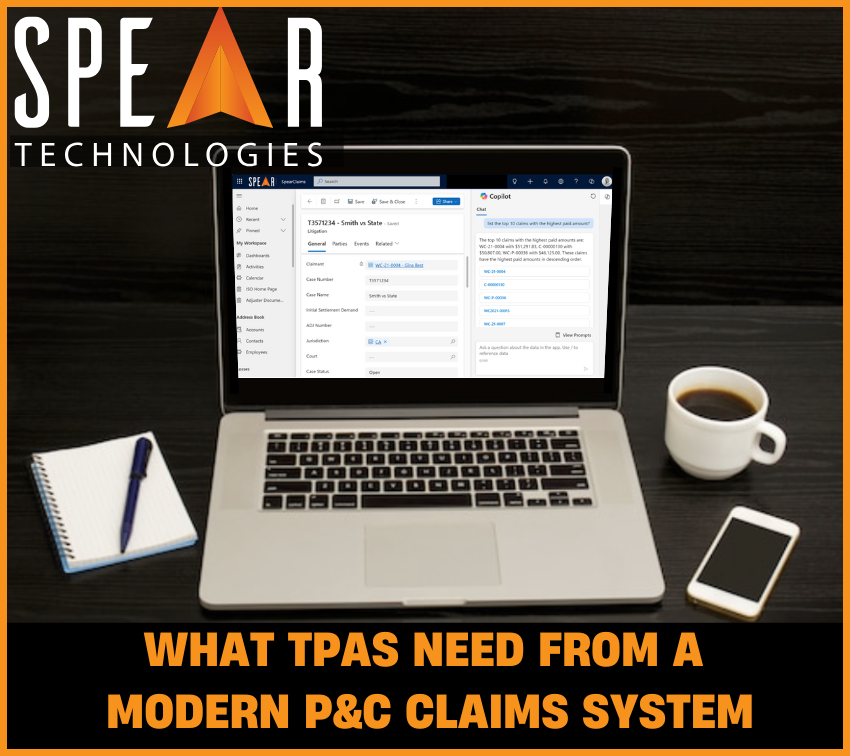

What TPAs Need from a Modern P&C Claims System: Flexibility, Intelligence, and Seamless Integration

Third Party Administrators (TPAs) are the operational backbone for many insurers, self-insured organizations, and public entities. Tasked with handling high volumes of claims across diverse clients – each with unique requirements – TPAs require more than just functional claims management software. They need modern Third-Party Administrator software that is agile, intelligent, and built for scale. […]

What Public Entities & Risk Pools Need from Their TPA’s Claims System: Visibility, Control, and Results

When organizations partner with Third Party Administrators (TPAs) to manage Property & Casualty claims, they expect more than just processing support—they expect strategic value, transparency, and outcomes that align with their goals. However, the effectiveness of a TPA relationship hinges on the capabilities of their claims management software. If the system lacks visibility, flexibility, or […]

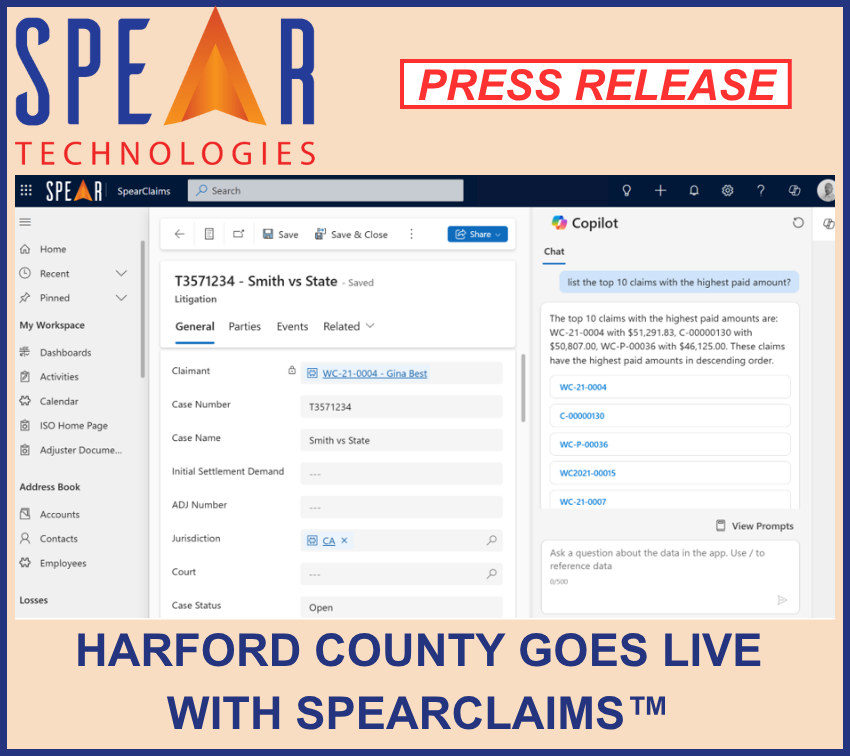

Harford County Has Gone Live with SpearClaims™ as Their New Claims Management Solution

Spear’s Claims Management Software Optimizes Claims Processing for Faster Response Times, Enhanced Data Security, Reduced Administrative Burden & Increased Operational Efficiency June 10, 2025 DENVER, CO – Spear Technologies (“Spear”), a leading provider of property and casualty insurance software solutions, is excited to announce that Harford County has gone live with SpearClaims™, as part of […]