For public entities and risk pools—such as municipalities, school districts, and JPAs—outsourcing claims to a Third-Party Administrator (TPA) is a strategic way to manage operational workload. But as expectations for accountability, transparency, and speed increase, so does the need for stronger collaboration and oversight. Fortunately, modern Claims Management Software balances transparency and autonomy, helping to […]

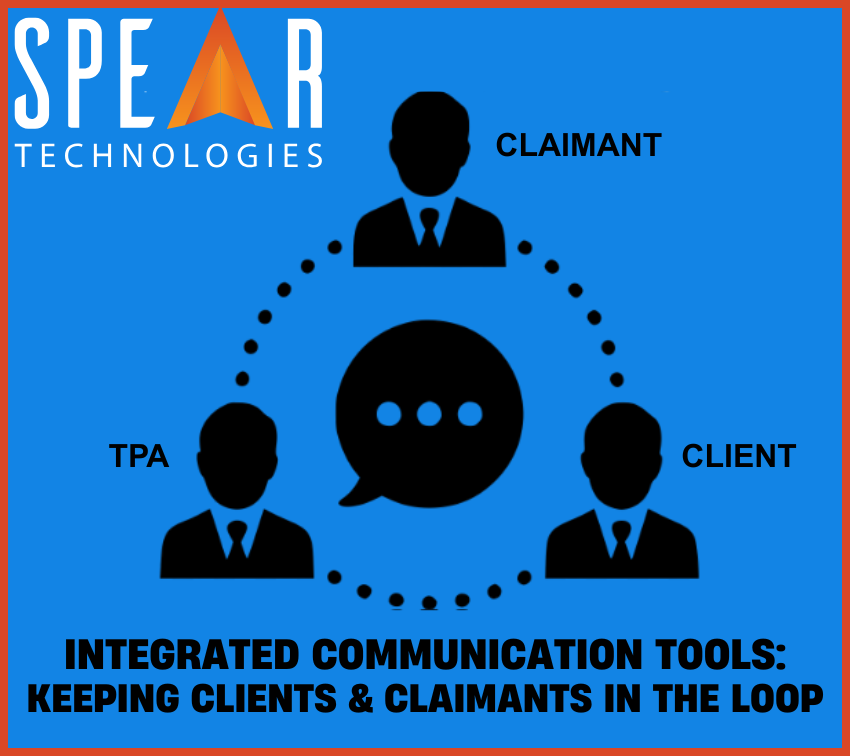

Integrated Communication Tools: Keeping Clients and Claimants in the Loop

In today’s complex insurance landscape, Third-Party Administrators (TPAs) must do more than just process claims—they must deliver seamless, transparent, and responsive service to both clients and claimants. With rising expectations around visibility and responsiveness, communication can no longer be an afterthought. That’s why integrated communication tools are now a must-have within any modern Claims Management […]

Supporting Multi-Agency & Multi-Member Configurations Without Losing Control

Achieve Centralized Oversight and Streamlined Operations with Claims Management Software Built for Complexity For public entities and risk pools—such as municipalities, school districts, and joint powers authorities (JPAs)—claims oversight is no longer a luxury; it’s a necessity. But with rising organizational complexity, how can your entity maintain transparency, compliance, and control across multiple agencies, departments, […]

Automating Claims Workflows Without Developers

In a rapidly changing insurance market, TPAs are expected to drive efficiency, transparency, and results—despite leaner teams and tighter timelines. Clients demand faster turnaround times, real-time visibility, and airtight compliance. But traditional claims handling processes, dependent on manual steps and IT intervention, can’t keep up. That’s where modern TPA Claims Management Software steps in—delivering automation […]

Choosing the Right Claims System for TPA Claims Management Oversight

Public entities and risk pools rely heavily on Third-Party Administrators (TPAs) to manage claims efficiently. But as expectations rise around transparency, compliance, and responsiveness, it is no longer enough to simply outsource claims handling. TPA claims management oversight, access, and collaboration are now just as critical to a successful program as claims resolution itself. That […]

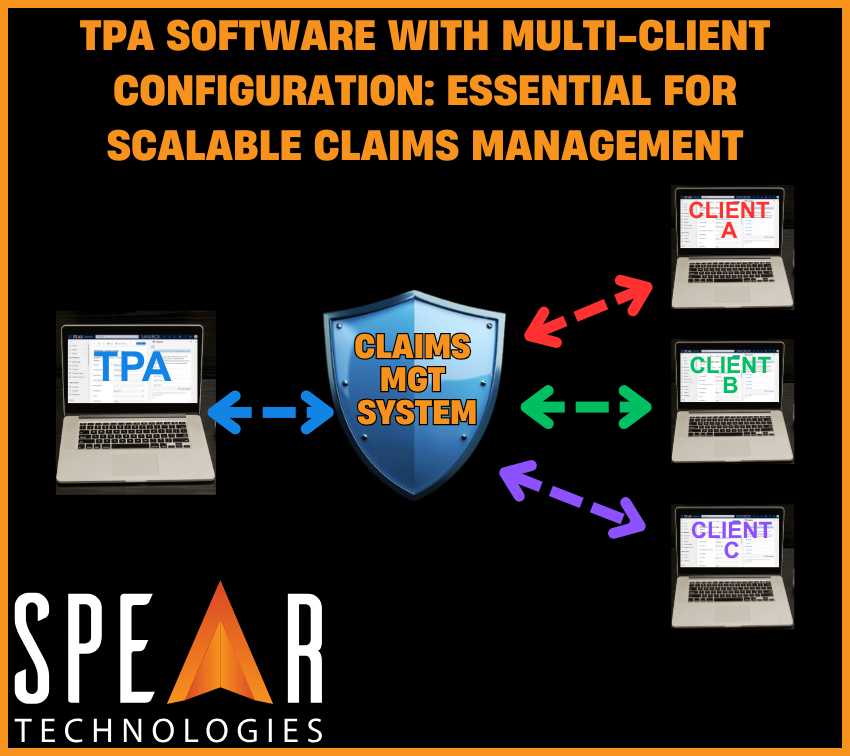

TPA Software with Multi-Client Configuration: Essential for Scalable Claims Management

In today’s competitive and compliance-driven environment, Third-Party Administrators (TPAs) must operate with increasing agility, precision, and transparency. As explored in our previous post, The Oversight Imperative: Why Public Entities Demand More Visibility Into Claims, public agencies and self-insured groups are demanding deeper insight into claims activity. But behind the scenes, a more foundational capability is […]

Evaluating a Claims Management System

In today’s dynamic insurance landscape, choosing the right Claims Management System is essential for achieving operational efficiency, meeting customer expectations, and driving long-term growth. For public entities, Third-Party Administrators (TPAs), risk pools, and insurance carriers, increasing demands around transparency, automation, and risk management make modernizing the Claims Management process a strategic priority. Why Choosing the […]

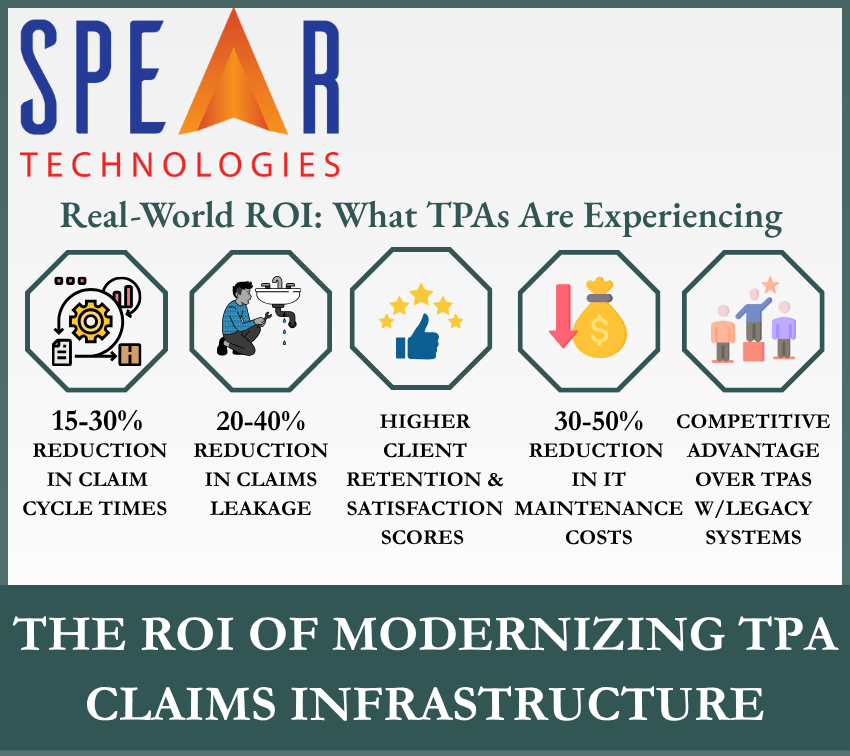

The ROI of Modernizing TPA Claims Infrastructure

Third-Party Administrators (TPAs) are under increasing pressure to deliver faster, more accurate, and more cost-effective claims handling services to their insurer, self-insured, and public entity clients. However, many TPAs are still operating on aging claims management solutions – Third-Party Administrator Software that limits their efficiency, inflates costs, and exposes them to operational risks like claims […]

The Oversight Imperative: Why Public Entities Demand More Visibility into Claims

For public entities—cities, counties, school districts, risk pools, and government agencies—claims management is no longer just an operational task; it’s a core element of fiscal responsibility, regulatory compliance, and public trust. As claim volumes rise and budgets tighten, these organizations face a growing imperative: take greater ownership of claims management oversight. Even when partnering with […]

Claims Management Software with Built-In AI: Why It Matters More Than Ever

In the world of insurance, terms like Claims Management Software, Claims Management System, and Claims Management Solution are often used interchangeably. They all refer to the digital backbone that enables insurers to process, manage, and resolve claims. But when it comes to Artificial Intelligence for Insurance, the differences between modern claims management software with built-in […]