As insurers prepare for 2026, Artificial Intelligence is entering a new phase. The conversation is no longer about whether AI can generate content or predict outcomes, it’s about how AI can coordinate work, manage complexity, and drive outcomes across systems. This shift is being driven by a rapidly emerging capability known as Agentic AI. Unlike traditional AI tools that respond […]

Why More Organizations Are Implementing Their Own Claims Management Systems – Even When Using a TPA

Outsourcing claims administration to a Third-Party Administrator (TPA) has long been a practical strategy for Public Entities & Risk Pools looking to reduce operational overhead. But as expectations for transparency, speed, and cost control increase, highlighting the need for better claims management oversight, more risk managers and claims leaders are rethinking the technology behind those […]

How Modern Claims Systems Help TPAs Deliver More Value

Third-Party Administrators (TPAs) are under growing pressure to do more than simply process claims—they’re expected to deliver measurable value to clients. Whether working with insurers, self-insured employers, or public entities, TPAs must demonstrate transparency, responsiveness, and cost efficiency. The right claims management software can be the difference between meeting client expectations and exceeding them. As […]

Evaluating Claims Management Software: A Guide for Insurance Organizations

In today’s evolving insurance landscape, selecting the right Claims Management Software is critical to operational success, customer satisfaction, and long-term profitability. As public entities, TPAs, risk pools, and insurers face increasing demands for efficiency, transparency, and risk mitigation, investing in the optimal Claims Management Solution becomes a key strategic priority. Why Choosing the Right Claims […]

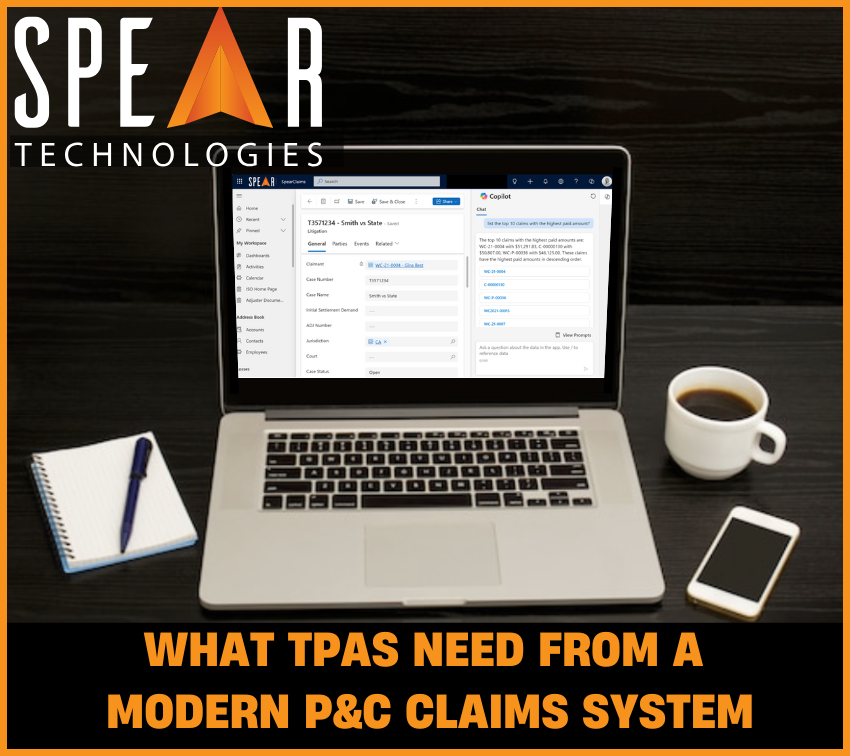

What TPAs Need from a Modern P&C Claims System: Flexibility, Intelligence, and Seamless Integration

Third Party Administrators (TPAs) are the operational backbone for many insurers, self-insured organizations, and public entities. Tasked with handling high volumes of claims across diverse clients – each with unique requirements – TPAs require more than just functional claims management software. They need modern Third-Party Administrator software that is agile, intelligent, and built for scale. […]

What Public Entities & Risk Pools Need from Their TPA’s Claims System: Visibility, Control, and Results

When organizations partner with Third Party Administrators (TPAs) to manage Property & Casualty claims, they expect more than just processing support—they expect strategic value, transparency, and outcomes that align with their goals. However, the effectiveness of a TPA relationship hinges on the capabilities of their claims management software. If the system lacks visibility, flexibility, or […]

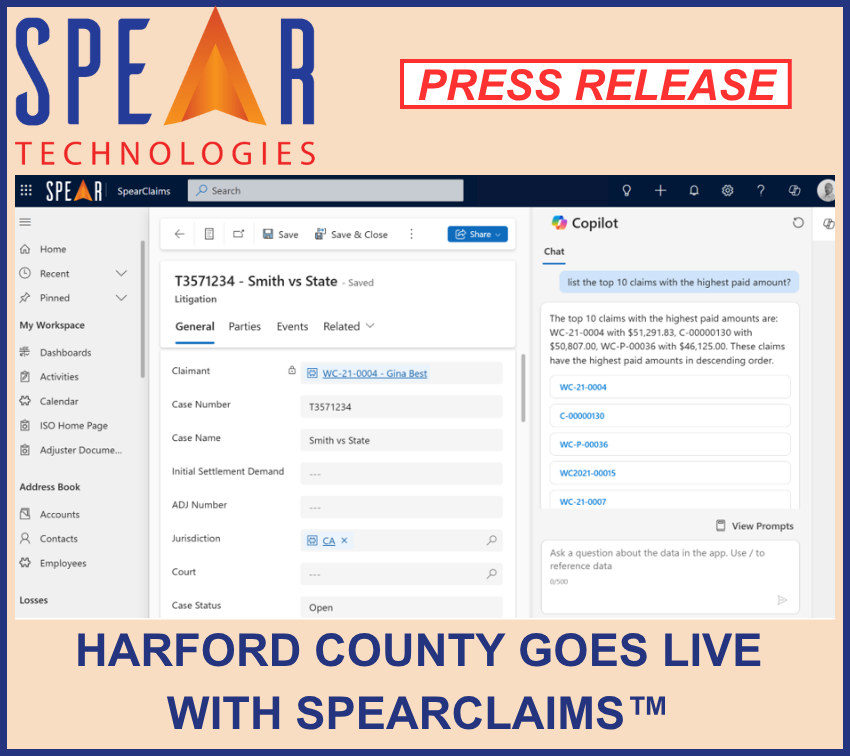

Harford County Has Gone Live with SpearClaims™ as Their New Claims Management Solution

Spear’s Claims Management Software Optimizes Claims Processing for Faster Response Times, Enhanced Data Security, Reduced Administrative Burden & Increased Operational Efficiency June 10, 2025 DENVER, CO – Spear Technologies (“Spear”), a leading provider of property and casualty insurance software solutions, is excited to announce that Harford County has gone live with SpearClaims™, as part of […]

What to Look for in a Claims Management System

A Buyer’s Guide for Carriers, TPAs, Public Entities, Risk Pools, and Self-Insureds As insurance organizations evolve, so do their expectations for technology. Legacy claims management software systems often fail to meet today’s need for automation, visibility, and speed. Whether you’re a carrier looking to modernize, a TPA serving multiple clients, a public entity managing complex […]

AI, Low-Code Platforms, and Customer-Managed Core Systems

How AI, Low-Code, and Customer-Managed Core Systems Are Transforming P&C Insurance The P&C insurance industry is evolving. Technology is changing how carriers manage policies, assess risk, and handle claims. AI, low-code platforms, and customer-managed core systems are driving this shift. These innovations improve efficiency and cut costs. They also give insurers more control and flexibility […]

Transforming Insurance with Low-Code/No-Code Platforms

As the insurance industry races toward digital transformation, carriers, TPA’s, MGAs and public entities are under pressure to modernize their core systems. Traditional software development can be time-consuming, expensive, and difficult to scale. Enter low-code/no-code insurance platforms: flexible, efficient, and cost-effective solutions that empower insurers to build and deploy applications faster than ever before. In […]