In today’s dynamic insurance landscape, choosing the right Claims Management System is essential for achieving operational efficiency, meeting customer expectations, and driving long-term growth. For public entities, Third-Party Administrators (TPAs), risk pools, and insurance carriers, increasing demands around transparency, automation, and risk management make modernizing the Claims Management process a strategic priority. Why Choosing the […]

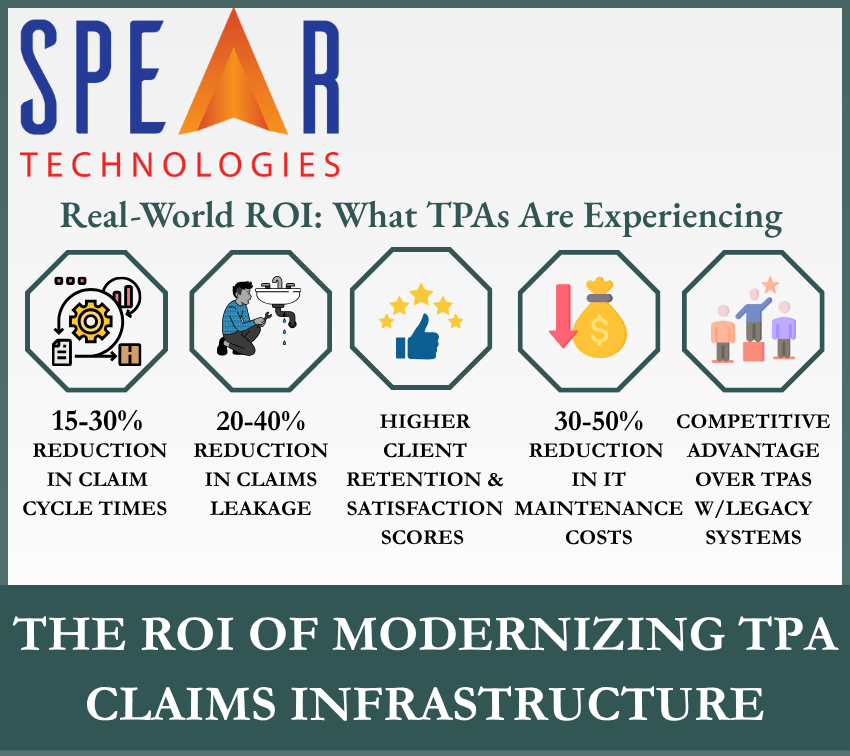

The ROI of Modernizing TPA Claims Infrastructure

Third-Party Administrators (TPAs) are under increasing pressure to deliver faster, more accurate, and more cost-effective claims handling services to their insurer, self-insured, and public entity clients. However, many TPAs are still operating on aging claims management solutions – Third-Party Administrator Software that limits their efficiency, inflates costs, and exposes them to operational risks like claims […]

Claims Management Software with Built-In AI: Why It Matters More Than Ever

In the world of insurance, terms like Claims Management Software, Claims Management System, and Claims Management Solution are often used interchangeably. They all refer to the digital backbone that enables insurers to process, manage, and resolve claims. But when it comes to Artificial Intelligence for Insurance, the differences between modern claims management software with built-in […]

Why More Organizations Are Implementing Their Own Claims Management Systems – Even When Using a TPA

Outsourcing claims administration to a Third-Party Administrator (TPA) has long been a practical strategy for Public Entities & Risk Pools looking to reduce operational overhead. But as expectations for transparency, speed, and cost control increase, highlighting the need for better claims management oversight, more risk managers and claims leaders are rethinking the technology behind those […]

How Modern Claims Systems Help TPAs Deliver More Value

Third-Party Administrators (TPAs) are under growing pressure to do more than simply process claims—they’re expected to deliver measurable value to clients. Whether working with insurers, self-insured employers, or public entities, TPAs must demonstrate transparency, responsiveness, and cost efficiency. The right claims management software can be the difference between meeting client expectations and exceeding them. As […]

Evaluating Claims Management Software: A Guide for Insurance Organizations

In today’s evolving insurance landscape, selecting the right Claims Management Software is critical to operational success, customer satisfaction, and long-term profitability. As public entities, TPAs, risk pools, and insurers face increasing demands for efficiency, transparency, and risk mitigation, investing in the optimal Claims Management Solution becomes a key strategic priority. Why Choosing the Right Claims […]

Accessible AI for Insurers

As the insurance industry evolves, so too must its approach to artificial intelligence. While AI has long promised transformative potential, the real opportunity lies in making it accessible – turning complex technologies into user-friendly, integrative tools that empower business users, not just data scientists. To truly harness the power of AI, insurance organizations can now […]

What to Look for in a Claims Management System

A Buyer’s Guide for Carriers, TPAs, Public Entities, Risk Pools, and Self-Insureds As insurance organizations evolve, so do their expectations for technology. Legacy claims management software systems often fail to meet today’s need for automation, visibility, and speed. Whether you’re a carrier looking to modernize, a TPA serving multiple clients, a public entity managing complex […]

AI, Low-Code Platforms, and Customer-Managed Core Systems

How AI, Low-Code, and Customer-Managed Core Systems Are Transforming P&C Insurance The P&C insurance industry is evolving. Technology is changing how carriers manage policies, assess risk, and handle claims. AI, low-code platforms, and customer-managed core systems are driving this shift. These innovations improve efficiency and cut costs. They also give insurers more control and flexibility […]