Insurance Technology Trends to Watch in 2026: From AI Capabilities to AI Orchestration

As the insurance industry looks toward 2026, technology conversations are shifting from whether to adopt AI to how to operationalize it responsibly, effectively, and at scale. Artificial Intelligence is no longer a novelty or a single feature: it is becoming a foundational layer of the best claims management software. The best P&C core systems now feature AI models embedded as a standard component, impacting claims management, policy administration, underwriting, customer engagement, and operations.

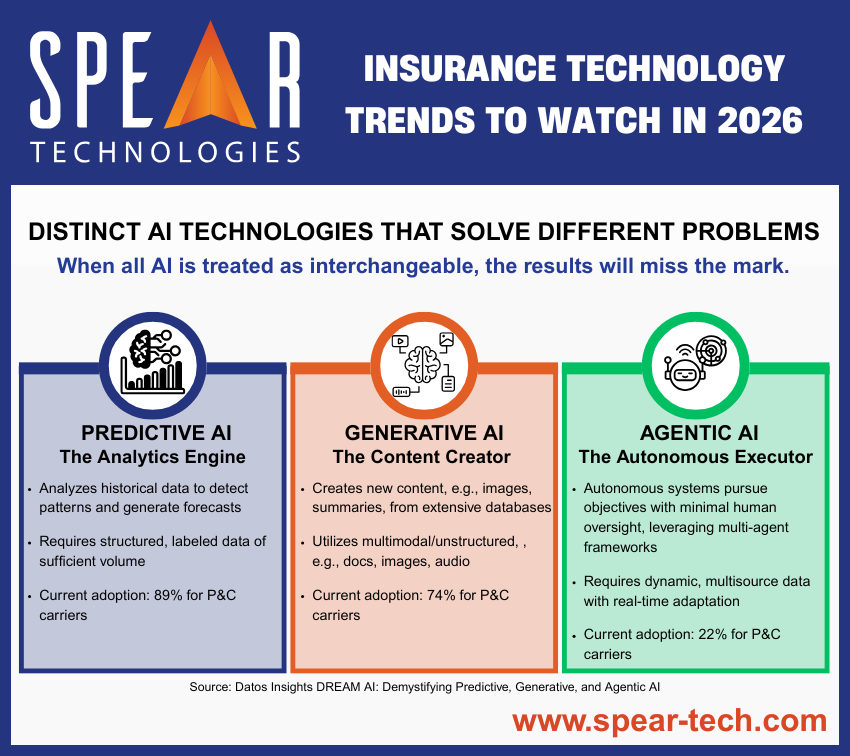

However, not all AI is created equal. Insurers are quickly learning that success depends on using the right AI models for the right tasks, embedding them directly into core platforms, and ensuring they are accessible to business users.

Insurers that succeed in 2026 will be those that understand the strengths of different AI approaches. Deploying multiple models together and embedding them directly into core systems in a way that business users, not just data scientists, can access, understand, and trust.

Below are the key technology trends insurers should be watching closely as they prepare for the next phase of digital transformation throughout 2026.

Trend #1: Predictive AI Becomes Core to Claims and Underwriting Decisions

Predictive AI—powered by machine learning and advanced analytics—has long supported insurance insights. In 2026, its role expands from analysis to real-time decision support embedded in core systems.

Predictive AI is now foundational to:

- Claims management systems for severity prediction, litigation risk, fraud detection, and subrogation opportunities

- Policy administration and underwriting for risk scoring, pricing guidance, and eligibility decisions

- Customer retention and churn prediction

The Best Claims Management Software will no longer treat predictive analytics as an add-on. Instead, insights will surface directly within adjuster workflows, helping claims professionals prioritize actions and outcomes at the moment decisions are made.

This shift also highlights the importance of Accessible AI: Predictive AI must be explainable, auditable, and trusted by business users, not hidden behind black-box models.

Trend #2: Generative AI Drives Productivity Across Insurance Operations

Generative AI has moved quickly from experimentation to practical application in insurance. In 2026, it will be a standard productivity layer across claims, policy, and customer communications.

Common Generative AI use cases include:

- Summarizing complex claims files and long claim histories

- Drafting claims correspondence, reports, and internal documentation

- Assisting with policy language and endorsement creation

- Enhancing customer and agent communications

Importantly, Generative AI works best when paired with other AI models such as NLP, expert systems, and Predictive AI to ensure accuracy, compliance, and context. This multi-model approach is becoming a defining characteristic of the best P&C core systems.

Generative AI does not replace insurance expertise; it amplifies it by reducing administrative burden and accelerating informed decision-making.

Trend #3: Agentic AI Introduces Goal-Driven Automation

One of the most important developments heading into 2026 is Agentic AI. Unlike traditional AI tools that respond to prompts, Agentic AI systems can take autonomous action toward defined business goals.

A question that frequently comes up is “What is the difference between robotics/automation and Agentic AI? At a high level, Agentic AI is the “brain” while robotics and autonomous systems are the “hands.”

Robotics and autonomous systems are execution mechanisms that follow fixed scripts to handle repetitive, predefined tasks with little or no human intervention. Agentic AI refers to AI systems that can operate toward a defined goal, make decisions across multiple step, invoke other AI models and tools, while monitoring outcomes and adapting behavior.

In insurance environments, Agentic AI supports:

- Claims triage and automated task orchestration

- Monitoring deadlines, exceptions, and compliance triggers

- Coordinating workflows across claims, policy, billing, and finance systems

- Proactively initiating next-best actions

Agentic AI doesn’t replace Predictive AI or Generative AI; it orchestrates them. This makes architecture critical: Agentic AI performs best when embedded directly into core platforms where it has access to real-time data and governed workflows.

By 2026, insurers evaluating the best claims management software and best policy administration systems will increasingly look for Agentic AI capabilities that drive operational efficiency without sacrificing oversight.

Trend #4: Multi-Model AI Architectures Become the Standard

A major lesson insurers are learning is that “AI” is not a single capability. Real-world insurance success depends on multiple AI models working together, each optimized for a specific purpose.

Leading insurers are combining:

- Predictive AI for forecasting risk and outcomes

- Generative AI for content creation and summarization

- NLP for extracting and understanding unstructured data

- Expert systems for rules-based decisions and compliance

- Agentic AI for orchestration and automation

The best P&C core systems in 2026 will be those designed to support this multi-model AI ecosystem, rather than forcing insurers to bolt on disconnected tools.

This approach also reinforces the value of Accessible AI, ensuring business users can configure, monitor, and trust AI outputs across models.

Trend #5: Built-In AI Overtakes Bolt-On Solutions

As AI becomes mission-critical, insurers are moving away from bolt-on AI tools in favor of built-in AI embedded directly into core systems.

Bolt-on solutions often introduce:

- Data latency and limited context

- Integration complexity

- Higher long-term costs

- Governance and compliance challenges

In contrast, built-in AI within claims management and policy administration systems enables:

- Real-time insights

- Consistent data models

- Stronger governance and auditability

- Faster adoption by business users

By 2026, the best claims management software and best policy management systems will be defined by how seamlessly AI is embedded into daily workflows, not by how many standalone AI features they advertise.

What This Means for Insurers in 2026

The next phase of insurance technology isn’t about chasing the newest AI trend—it’s about orchestration, accessibility, and integration.

Insurers preparing for 2026 should be asking:

- Do we support multiple AI models across different functions?

- Are our AI capabilities built into core systems or bolted on?

- Can business users understand, trust, and configure AI outcomes?

- Are we using AI to assist decisions, or to automate responsibly?

- Are we using Predictive AI, Generative AI, and Agentic AI together, or in silos?

- Do our platforms support multiple AI models as needs evolve?

Insurers that answer these questions effectively will be positioned to improve efficiency, reduce loss costs, and deliver better experiences across claims and policy lifecycles.

Looking Ahead

The future of insurance technology isn’t about adopting the latest AI trend—it’s about orchestrating the right AI models within the right core systems.

As insurers evaluate the ideal core systems, Accessible AI, multi-model architecture, and built-in intelligence will separate true industry leaders from those still experimenting.

In 2026, success will belong to insurers who move beyond AI hype and focus on AI that works—inside their core systems, across their workflows, and for their people.

Conclusion: The Future of Insurance Technology Is Built-In, Multi-Model, and Accessible

As the insurance industry moves into 2026, the conversation around AI is no longer about experimentation, its about execution at scale. Leading insurers are shifting away from isolated tools and bolt-on solutions toward core platforms where Predictive AI, Generative AI, and Agentic AI work together inside daily workflows.

The most effective insurance organizations recognize that no single AI model can meet every need. Instead, they are adopting multi-model AI architectures that support forecasting, automation, content generation, and intelligent orchestration while remaining transparent, governed, and usable by business teams. This is the defining characteristic of the Best Claims Management Software and the Best P&C Core Systems heading into 2026.

Solutions such as SpearClaims™ and SpearPolicy™, part of Spear’s end-to-end core solution SpearSuite™, are purpose-built for this reality. AI is not layered on after the fact, it is built directly into claims management and policy administration workflows. This enables insurers to:

- Apply Predictive AI to improve claims outcomes and underwriting decisions

- Use Generative AI to streamline documentation, communication, and analysis

- Leverage Agentic AI to orchestrate tasks, manage exceptions, and drive next-best actions

- Maintain human oversight through an Accessible AI framework that prioritizes explainability and control

For insurers evaluating technology investments today, the question is no longer whether to adopt AI, but which core systems are designed to evolve as AI advances

When assessing the Best Claims Management Software or Best P&C Core Systems for the future, look beyond surface-level AI features. Instead, focus on platforms built for long-term intelligence.

Schedule a demo of SpearClaims™, SpearPolicy™, and SpearSuite™ to see how built-in, Accessible AI powered by Predictive, Generative, and Agentic AI can help your team work smarter, move faster, and stay in control as the insurance industry evolves.