The ROI of Modernizing TPA Claims Infrastructure

Third-Party Administrators (TPAs) are under increasing pressure to deliver faster, more accurate, and more cost-effective claims handling services to their insurer, self-insured, and public entity clients. However, many TPAs are still operating on aging claims management solutions – Third-Party Administrator Software that limits their efficiency, inflates costs, and exposes them to operational risks like claims leakage.

Investing in a modern Third-Party Administration Solution is no longer a luxury—it’s a strategic imperative. In this article, we explore how modernizing your TPA Claims Infrastructure delivers measurable ROI across multiple dimensions, and why leading organizations are turning to top insurance core platforms to stay competitive.

The Business Case for Modern Claims Systems

1. Operational Efficiency through Claims Automation Software

One of the most immediate returns TPAs experience when implementing modern Third-Party Administration Software is operational efficiency. Legacy systems often require manual data entry, redundant processes, and extensive human intervention. In contrast, today’s best TPA Software platforms leverage:

- Claims automation software for FNOL submission, document ingestion, and task routing

- Intelligent workflows that minimize human touchpoints

- Integrated communication tools that eliminate back-and-forth emails and phone calls

- Smart Summarization to condense email, notes, and claim timelines to reduce review time and enable faster decisions.

The result is faster cycle times, lower labor costs, and improved accuracy—key contributors to ROI.

2. Reduction in Claims Leakage

Claims leakage—unnecessary or excessive claim payments—is one of the most significant cost drivers in claims management. Modern Claims leakage prevention solutions use advanced analytics, AI-driven flagging, and real-time data validation to detect:

- Duplicate claims

- Excessive medical or repair charges

- Fraudulent or exaggerated claims

By proactively identifying and mitigating leakage, TPAs can protect their bottom line and deliver tangible savings to their clients.

3. Improved Client Retention and Satisfaction

Today’s insurers and self-insured organizations expect their TPAs to offer:

- Real-time reporting and analytics

- Transparent claim status tracking

- Seamless integrations with client systems

A modern Third-Party Administration System enables TPAs to deliver a superior client experience, which translates to higher satisfaction, stronger retention rates, and an enhanced reputation in the marketplace.

4. Scalability and Growth Enablement

Outdated systems often limit a TPA’s ability to take on new business or expand service offerings. In contrast, modern TPA Solutions provide scalable architecture that supports:

- Multi-line and multi-jurisdictional claims handling

- Configurable workflows for new lines of business

- Easy integration with partner ecosystems and client platforms

This scalability allows TPAs to pursue growth opportunities with confidence, knowing their Third-Party Administration Software can handle increased volume without sacrificing performance.

5. Enhanced Compliance and Risk Management

Regulatory compliance is a non-negotiable part of the claims process. Modern Claims management software includes built-in compliance checks, audit trails, and automated reporting to ensure adherence to evolving legal and industry standards. This reduces the risk of fines, penalties, and reputational damage—an often-overlooked but critical component of ROI.

6. Reduced IT Costs and Greater Flexibility

Legacy TPA Systems often require expensive customizations, difficult upgrades, and ongoing IT support. Today’s top insurance core platforms are typically cloud-based, offering:

- Lower infrastructure and maintenance costs

- Faster updates and enhancements

- Minimal disruption during system upgrades

This allows TPAs to allocate resources more strategically and focus on delivering value to clients rather than managing IT headaches.

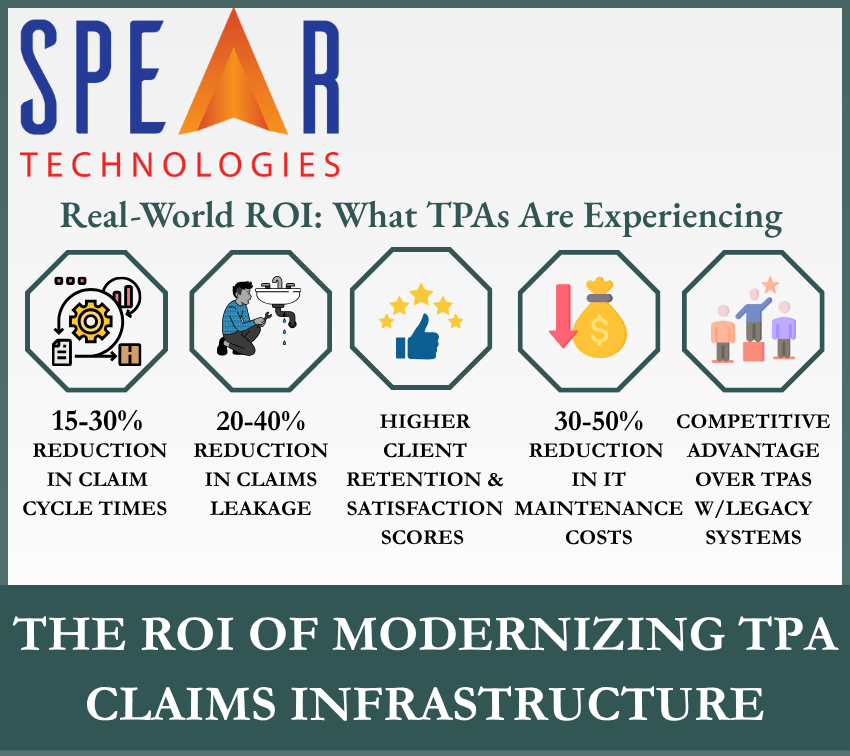

Real-World ROI: What TPAs Are Experiencing

TPAs who have modernized their claims infrastructure are reporting:

- 15-30% reduction in claim cycle times

- 20-40% reduction in claims leakage

- 30-50% reduction in IT maintenance costs

- Higher client retention and satisfaction scores

These gains directly impact profitability, market competitiveness, and long-term sustainability.

Choosing the Right Third-Party Administrator Software

Not all TPA Software platforms are created equal. When evaluating options, TPAs should look for:

- Proven expertise in Third-Party Administration

- Configurable workflows that fit unique client needs

- Advanced claims automation and leakage prevention tools

- Integration capabilities with client and third-party systems

- Robust reporting and analytics features

- Cloud-native architecture for scalability and cost efficiency

Partnering with a provider that offers a modern, comprehensive Third-Party Administration Solution positions TPAs to thrive in a rapidly evolving insurance landscape.

Conclusion

The ROI of modernizing TPA Claims Infrastructure is compelling and multifaceted. From operational efficiencies and leakage prevention to client satisfaction and growth enablement, modern TPA Solutions deliver measurable business value. As competition intensifies and client expectations rise, TPAs that invest in modern Third-Party Administration Systems will be best positioned to lead the industry forward.

SpearClaims™: The Future-Ready TPA Claims Platform

SpearClaims™ was built with TPAs in mind. Designed by industry experts and powered by a low-code/no-code architecture, it delivers:

- Fast onboarding of new clients

- AI-powered automation

- Robust reporting and analytics

- Seamless ecosystem integration

- Built-in claims leakage solutions and subrogation capabilities

Ready to deliver more value to your clients?

Discover a smarter, faster and more efficient way to manage claims.

Schedule a Demo to see first-hand how SpearClaims™ empowers TPAs to simplify and accelerate claims processing while reducing operational costs. Built by industry experts on a modern low-code/no-code platform, SpearClaims™ is a future-ready Third-Party Administrator Software solution that combines next-generation AI and analytics to eliminate inefficiencies, prevent claims leakage, and optimize every stage of the claims lifecycle.

To discover how Spear’s solutions are accessible to insurers of all sizes, Request Pricing.