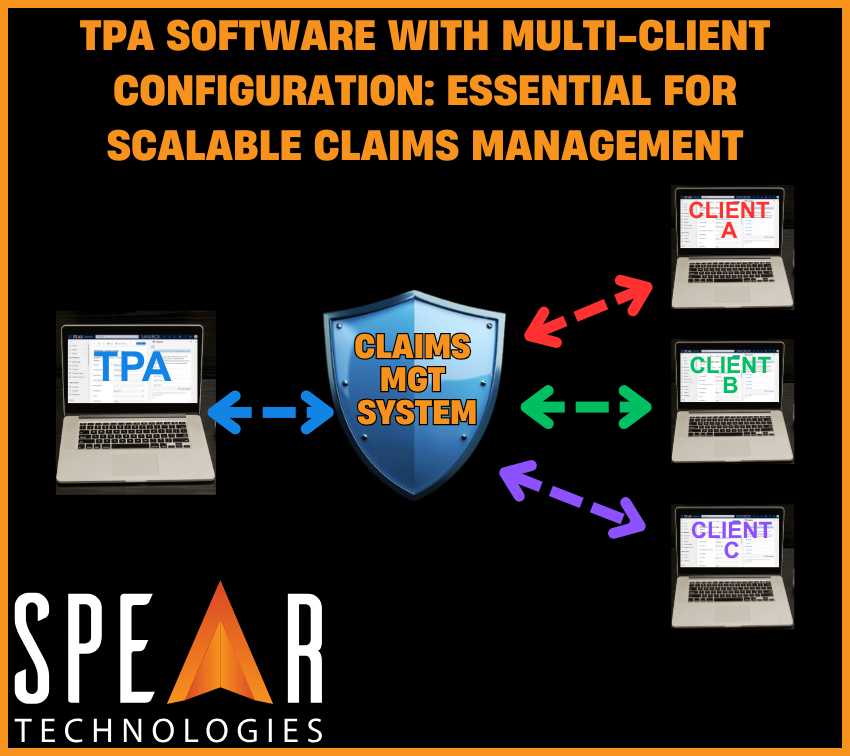

TPA Software with Multi-Client Configuration: Essential for Scalable Claims Management

In today’s competitive and compliance-driven environment, Third-Party Administrators (TPAs) must operate with increasing agility, precision, and transparency. As explored in our previous post, The Oversight Imperative: Why Public Entities Demand More Visibility Into Claims, public agencies and self-insured groups are demanding deeper insight into claims activity. But behind the scenes, a more foundational capability is required to meet these rising expectations—TPA software with multi-client configuration.

For TPAs aiming to scale effectively while delivering tailored service to a broad portfolio of clients, the ability to securely manage diverse client configurations is not just a nice-to-have—it is an operational imperative.

What Is Multi-Client Configuration?

Multi-client configuration refers to a claims management system architecture that allows a TPA to manage multiple clients within a single platform—each with distinct business rules, user permissions, workflows, branding, and data segmentation.

A truly modern Third-Party Administration Solution supports this structure natively, allowing TPAs to onboard new clients quickly, reduce administrative overhead, and deliver personalized service—all while maintaining airtight data privacy and compliance standards.

Why Multi-Client Configuration Matters to TPAs

1. Support for Unique Client Requirements

Every client—whether a self-insured public entity, risk pool, or private organization—has its own reporting standards, claims processes, and regulatory obligations. Without multi-client support, TPAs are often forced to:

- Manage complex spreadsheet workarounds

- Operate multiple instances of the same software

- Perform manual customizations that slow down operations

With a flexible TPA System that allows for modular configuration, TPAs can deliver custom workflows and analytics per client without re-engineering the platform every time.

2. Scalability Without Compromise

Growing your book of business should not mean multiplying your administrative burden. A scalable Third-Party Administration System enables you to:

- Onboard new clients faster

- Maintain consistency in claims handling

- Configure rules-based automation tailored to client specifics

As TPAs look to expand their footprint, the ability to scale efficiently is directly tied to how well their TPA software handles multi-client complexity.

3. Data Security and Segmentation

Client data must not only be isolated for security and privacy—it must also be role-based and permission-controlled. A high-quality claims management system will ensure:

- No cross-client data exposure

- Compliance with HIPAA and other regulatory mandates

- Secure access at every level: organizational, role, and claim

This level of control is essential when TPAs serve government clients or work across industries with varying legal frameworks.

4. Efficiency Through Automation

When multi-client setups are supported within the same instance of a platform, automation can be applied more broadly and efficiently. Claims automation software can trigger customized alerts, approvals, and documentation processes based on client-specific rules—helping reduce manual errors, speed up resolution times, and improve accuracy.

What to Look for in a Multi-Client Capable TPA Software Solution

As TPAs evaluate top insurance core platforms, they should prioritize solutions that offer:

- Configurable client environments without the need for separate logins

- Custom reporting and dashboards per client

- Role-based permissions and audit trails

- Integrated claims automation tools

- Flexible API integrations with client-preferred systems

Platforms like these allow for true operational flexibility and empower TPAs to act as strategic partners—not just service providers.

Conclusion

TPAs today are navigating increasingly complex demands from a growing and diverse client base. Without a Third-Party Administration Software platform that supports secure, flexible, and scalable multi-client configuration, the risk of inefficiency, non-compliance, and client dissatisfaction rises sharply.

To succeed in this evolving landscape, TPAs must invest in modern TPA Systems that combine robust claims management software capabilities with the agility to adapt per client. The ability to configure once and serve many—securely and effectively—is what separates high-performing TPAs from the rest.

Discover a smarter, faster, and more efficient way to manage claims.

Schedule a Demo to see first-hand how SpearClaims™ multi-client configuration TPA software empowers TPAs to better serve the unique needs across a diverse client portfolio while simplifying and accelerating claims processing and reducing operational costs. Built by industry experts on a modern low-code/no-code platform, SpearClaims™ is a future-ready claims management software solution that combines next-generation AI and analytics to eliminate inefficiencies, prevent claims leakage, and optimize every stage of the claims lifecycle.

To discover how Spear’s solutions are accessible to insurers of all sizes, Request Pricing.