Accessible AI for IT Leaders: Intelligent Document Processing – Reducing Technical Debt and Vendor Reliance

For IT leaders in insurance, the stakes have never been higher. Legacy claims systems, siloed data flows, and brittle point solutions force teams into a constant cycle of patching and maintaining rather than innovating. At the same time, the volume and complexity of documents—from First Notice of Loss (FNOL) submissions to medical bills and vendor invoices—continues to grow.

And make no mistake—the stakes are high.

Consider the costs of high-risk claims by Line of Business:

- Property: A single catastrophic event recently cost insurers over $100 billion—and these incidents have increased by 40% in recent years.

- Healthcare: Escalation drove more than $18 billion in claims costs in 2023 alone.

- Worker’s Compensation: The average large claim now exceeds $3 million.

- Commercial Auto: Claim costs are up $30 billion over the past decade, fueled by higher bodily injury payouts, escalating litigation, and pricier vehicle repairs tied to advanced technology.

With stakes this high, organizations can no longer afford to wait until problems surface. This is where Accessible AI changes the game – empowering teams to identify high-risk claims earlier, intervene faster, and prevent escalation before costs spiral out of control.

Traditional approaches to document automation, such as standalone OCR projects or heavy vendor solutions, often create more problems than they solve. They require expensive integrations, lock carriers into rigid contracts, and produce data that still needs manual cleanup.

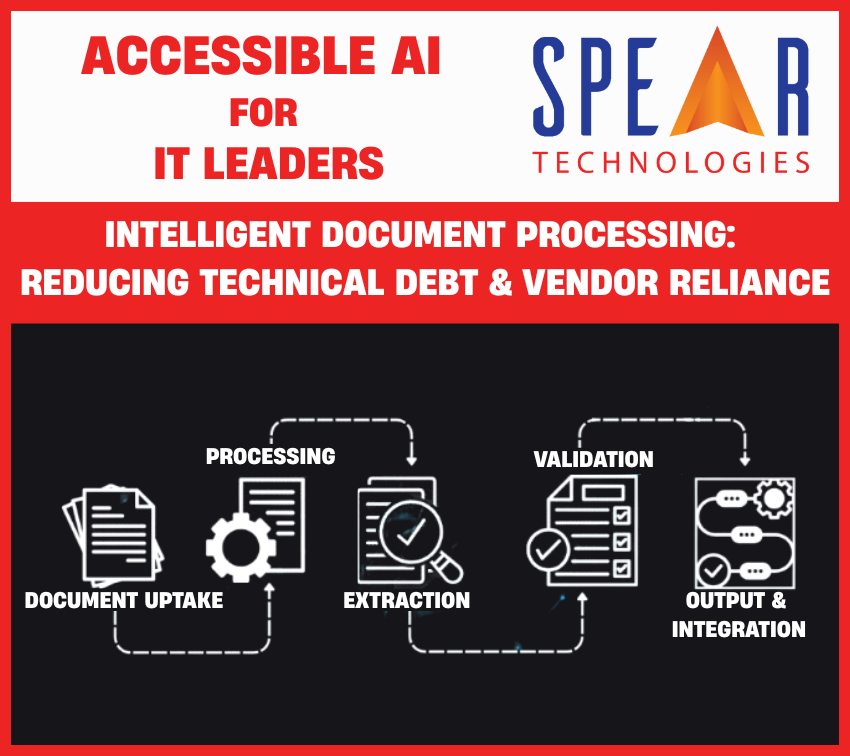

Accessible AI changes that equation. By bringing intelligent document processing (IDP) into the hands of IT and business users, organizations can streamline data capture, reduce reliance on vendors, and dramatically cut technical debt.

Empowering Business Users with AI They Can Shape

If you read the first article in this series, you’ll recognize this section—it’s worth repeating. Every Accessible AI use case builds on this core principle: giving business users the power to shape AI models directly, without waiting on IT or data science teams.

One of the most transformative aspects of accessible AI in insurance is the shift from developer-led to business-led model interaction. In traditional setups, any customization or retraining of AI models requires intervention from IT teams, data scientists, or external vendors. This dependency creates bottlenecks, slows innovation, and disconnects model development from those who understand the business problems best—your underwriters, claims adjusters, fraud investigators, and customer experience teams.

Why Business-User Accessibility Is a Game-Changer

When AI tools are designed for business users, the result is more responsive, agile, and relevant model development. Empowering business users to adapt and train AI models on their own yields multiple advantages:

- Faster Time-to-Value: No waiting on IT backlogs or vendor response times

- Higher Accuracy: Models reflect real-world operational needs and are continually refined by domain experts

- Greater Adoption: Tools that align with existing workflows and skill sets see higher engagement

- Scalable Innovation: Business teams become active participants in digital transformation, not passive consumers

Intelligent Document Processing for Insurance

Documents remain the backbone of claims and underwriting operations. But in most carriers and TPAs, handling them is still a resource drain:

- FNOL reports arrive in multiple formats—emails, PDFs, handwritten notes—that require manual data entry into core systems.

- Medical bills are often inconsistent, forcing IT to maintain one-off scripts or rely on third-party vendors for parsing.

- Vendor invoices clog workflows, with mismatched formats that lead to errors, delays, and reconciliation headaches.

Accessible AI-powered document processing takes a different approach. Instead of rigid OCR systems, it combines natural language processing (NLP), pattern recognition, and low-code tools that IT leaders and business users can configure themselves.

The result: faster document ingestion, cleaner data, and far fewer costly integrations.

How Accessible AI Eliminates OCR Fragility

Most IT leaders have seen OCR projects fail or balloon in cost because of:

- Template dependency – Minor format changes break extraction logic.

- Vendor lock-in – Proprietary engines prevent flexibility or migration.

- Manual cleanup – Extracted data still requires validation and correction.

Accessible AI solves these issues by enabling low-code, model-driven automation:

- Adaptive learning – Models improve over time as business users flag errors or refine rules.

- Low-code configuration – IT teams can adjust extraction logic without deep coding or costly vendor calls.

- Seamless integration – Data flows directly into core claims or policy systems, eliminating “swivel-chair” workarounds.

For IT leaders, this means fewer brittle scripts to maintain, less reliance on third parties, and lower overall technical debt.

Case Study: Cleaner Data, Fewer Patches

One mid-size insurer struggled with manual FNOL intake and vendor-dependent bill processing. Every new form required IT to write a custom parser or wait weeks for the vendor to update templates. Data often entered the claims system incomplete or inaccurate, forcing adjusters to fix errors.

By shifting to Accessible AI for intelligent document processing, the insurer:

- Automated FNOL intake from multiple formats with over 90% accuracy.

- Reduced vendor reliance by empowering IT analysts to configure extraction logic directly.

- Eliminated more than a dozen “patch” scripts previously used to normalize data.

The result was a smoother claims workflow, cleaner system-of-record data, and a 25% reduction in IT backlog tied to document-related requests.

Why It Matters for IT Leadership

For IT executives, Accessible AI is more than a productivity tool—it’s a strategy to reduce complexity, cut technical debt, and regain control from overextended vendor contracts. Intelligent Document Processing is just one example of how IT leaders can modernize operations without adding more brittle systems.

- Less time firefighting integrations.

- More time enabling innovation.

- Cleaner data flowing into claims and policy systems.

That’s the promise of Accessible AI: technology you can shape, scale, and trust.

Next in the Series: In the next article in the Accessible AI for IT Leaders series, we’ll explore AI-Powered Fraud Detection and how IT leaders can balance advanced analytics with compliance, oversight, and system efficiency.

Ready to see how SpearClaims™ can help your team do more with less?

Schedule a Demo to see how SpearClaims™ with accessible AI empowers IT leaders to modernize systems, reduce technical debt, and deliver innovation without adding complexity..

Request Pricing to learn how cost-effective it can be to simplify your technology landscape, manage vendor reliance, and deliver scalable modernization.