Claims Management - Policy Administration & Billing - Agent & Policyholder Portals - AI, Analytics & Bots

Accessible AI in SpearSuite™

We’re thrilled to share the latest AI-driven innovations now available in SpearSuite™. Accessible AI allows business users to tailor AI models to their specific needs, helping you work smarter, respond faster, and make more informed decisions with less effort.

Artificial Intelligence for Insurance

What is Accessible AI?

Accessible AI refers to artificial intelligence tools that are designed to be utilized by business leaders without the need for data scientists, IT, or external vendors.

What are the Core Capabilities of Accessible AI?

Accessible AI empowers business users to:

-

Create and Modify Workflows

-

Configure document classifications and data extraction

-

Summarize claim files, documents, and notes instantly

-

Search across all documents and notes using natural language

-

Automate repetitive tasks and routing rules

-

Review and approve AI outputs through Human-in-the-Loop controls

-

Identify missing documentation and compliance gaps

-

Detect patterns, anomalies, and early-warning indicators

-

Generate claim narratives, summaries, and correspondence drafts

-

Transfer data across forms and screens automatically (Smart Paste)

-

Run predictive insights such as severity, litigation likelihood, or subrogation potential

-

Configure prompts, rules, and automations without coding

-

Continuously improve processes through low-code iterations

-

Integrate AI outputs directly into claims systems and workflows

Why is Accessible AI a Game-Changer?

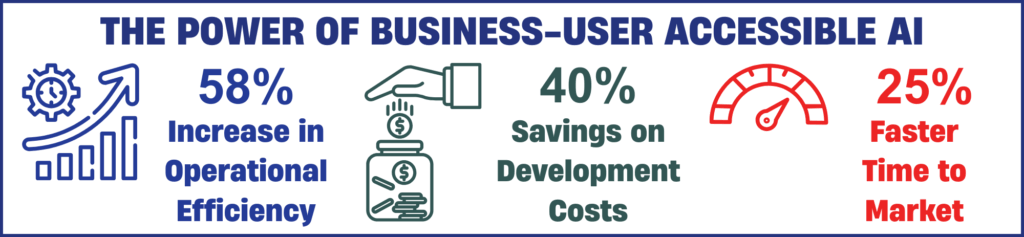

When AI tools are designed for business users, the result is more responsive, agile, and relevant model development. empowering business users to adapt and train AI models on their own yields multiple advantages:

-

Faster Time-to-Value: No waiting on IT backlogs or vendor response times.

-

Higher Accuracy: Models reflect real-world operational needs and are continually refined by domain experts.

-

Greater Adoption: Tools that align with existing workflows and skill sets see higher engagement.

-

Scalable Innovation: Business teams become active participants in digital transformation, not passive consumers.

Spear Technologies

SpearAI™

Spear's Next-Generation AI Capabilities leverage generative AI, predictive analytics, and intelligent automation to address key pain points for insurers and public entities.

Accessible AI delivers a more seamless, intuitive experience, allowing business users to tailor AI models to their specific needs and domain realities—ensuring the AI not only works but works for them.

No developers are necessary, saving time while giving teams greater control, enhanced capabilities, and a stronger return on technology investment.

Explore the power of Accessible AI - click on a Next-Generation AI Capability to learn more »

To read more regarding Business User Accessible AI for Claims Administration:

What it is:

Predictive analysis uses embedded AI models to forecast outcomes like claim severity, litigation likelihood, and other business risks.

What problem it solves:

Claims and underwriting teams lack proactive visibility into high-risk or costly cases, leading to reactive rather than strategic decisions.

How it works:

Predictive models analyze historical and real-time claim and policy data against business rules and notification logic to assess risk and flag cases that may escalate.

What happens next:

Teams receive early warning insights, enabling interventions such as rerouting work, initiating reviews, or prioritizing resources to improve outcomes

What it is:

An AI-driven capability that condenses long notes, emails, documents, and activity logs into concise, actionable summaries.

What problem it solves:

Users spend excessive time reading through lengthy content to understand key actions, slowing decisions and productivity.

How it works:

Accessible AI scans unstructured text across claims files and communications, identifies the most relevant points, and generates clear, structured summaries.

What happens next:

Adjusters and managers save time on review, focus on what matters most, and make faster, more informed decisions.

What it is:

An AI-assisted email tool that extracts key claim details and generates responses directly within your email threads.

What problem it solves:

Manually responding to inbound emails is repetitive, slow, and error-prone—especially when updating claim records.

How it works:

Generative AI reads incoming correspondence, identifies relevant claim information, and proposes or auto-generates accurate in-thread responses with customizable tone and length.

What happens next:

Teams respond more quickly and consistently, reduce manual effort, and keep claim files up to date with less risk of error. spear-tech.com

What it is:

A dual AI capability that generates draft responses and evaluates message sentiment.

What problem it solves:

Teams can miss early signs of dissatisfaction or urgency in claimant/stakeholder communications, and crafting responses manually is slow.

How it works:

AI assesses incoming messages for tone and urgency, suggests responses in the appropriate style/length, and alerts supervisors to negative sentiment.

What happens next:

Faster, more effective communications help retain claimant trust, enable early corrective action, and improve service outcomes.

What it is:

AI models that automatically extract key data from documents like policies, invoices, medical reports, and correspondence.

What problem it solves:

Manual data entry and document review are time-intensive and prone to errors.

How it works:

Customized extraction models parse structured and unstructured documents, pull relevant fields, and populate records in SpearSuite™ without manual rekeying.

What happens next:

Operational efficiency improves, data quality increases, and staff are freed to focus on higher-value work rather than repetitive tasks.

What it is:

AI-powered self-service agents that interact securely with vendors or stakeholders in real time.

What problem it solves:

High volumes of routine status requests and tasks consume staff time and slow operational workflows.

How it works:

Virtual agents connect to system data and logic to answer queries, trigger tasks, and automate routine business processes using predefined rules and AI intelligence.

What happens next:

Stakeholders get real-time answers and services without staff involvement, increasing operational efficiency and availability.

What it is:

A contextual AI feature that suggests form field entries based on copied content.

What problem it solves:

Repetitive manual form entry is time-consuming and increases the risk of error.

How it works:

The feature analyzes copied text and proposes relevant form field values inline, allowing users to accept or ignore suggestions.

What happens next:

Data entry becomes faster and more accurate, reducing rework and improving throughput for forms or data tasks.

What it is:

A conversational AI assistant that helps users interact with SpearSuite™ through natural language.

What problem it solves:

Users often struggle to navigate complex systems or extract insights without technical queries or support.

How it works:

CoPilot interprets natural language questions and provides guidance, navigates to relevant areas, or surfaces insights and recommendations in context.

What happens next:

Users spend less time searching for information or waiting for support, and more time making timely, confident decisions.

Overview:

A business user deployed 12 distinct AI models directly within SpearSuite™ to automate previously manual tasks. These models are configured and managed by the user—without coding—using the platform’s Accessible AI tools to read invoices, index documents, enter payments, and summarize notes.

Results:

The organization achieved measurable efficiency gains by automating repetitive work, reducing manual effort, and accelerating processing times for key operational tasks. This live use case demonstrates how Accessible AI can be operationalized across workflows to increase productivity and drive measurable value within insurance operations.

Next-Generation AI Capabilities for your

Carrier Third Party Administrator Risk Pool Public Entity Self-Insured Group Self-Insured Employer

These Accessible AI innovations are now available to all Spear clients and can be customized to meet the specific needs of your organization

Discover the power of Spear's Next-Generation AI Capabilities - Artificial Intelligence for Insurance