Evaluating a Claims Management System

In today’s dynamic insurance landscape, choosing the right Claims Management System is essential for achieving operational efficiency, meeting customer expectations, and driving long-term growth. For public entities, Third-Party Administrators (TPAs), risk pools, and insurance carriers, increasing demands around transparency, automation, and risk management make modernizing the Claims Management process a strategic priority.

Why Choosing the Right Claims Management System Matters

The right Claims Management System goes beyond basic claims processing. It becomes a central platform that powers automation, enables smarter decision-making, and ensures compliance. As the complexity of Claims Management in Insurance grows, organizations need systems that are flexible, intelligent, and scalable.

Investing in a forward-thinking Claims Management System empowers insurance teams to reduce administrative overhead, streamline workflows, and deliver better results for claimants and stakeholders alike.

Key Features to Look for in a Claims Management System

When evaluating a Claims Management System, it’s important to focus on capabilities that align with both current needs and future growth:

- Automation & Workflow Management

Speed up claims handling with configurable, rules-based automation that reduces manual intervention. - Integration Capabilities

Ensure seamless compatibility with core systems, third-party data providers, and financial platforms. - Advanced Reporting & Analytics

Leverage data insights to support smarter decision-making and more accurate Risk Assessment in Insurance. - Security & Compliance

Protect sensitive information and stay ahead of evolving regulatory demands. - User-Friendly Interface

Provide adjusters, supervisors, and administrators with intuitive tools that improve productivity and satisfaction.

A comprehensive Claims Management System ensures these components work together to maximize efficiency and business value.

Enhancing Risk Assessment for Insurance Through Your Claims Management System

One of the most transformative benefits of a modern Claims Management Solution is its ability to enhance Risk Assessment for Insurance. By aggregating and analyzing historical and real-time data, organizations can:

- Detect high-risk claims early in the lifecycle

- Identify potential fraud with AI-powered insights

- Support underwriting through predictive analytics

- Fine-tune reserves based on claim trends

- Strengthen loss prevention efforts across the portfolio

With Accessible AI integrated into the platform, even small-to-midsize insurers can leverage enterprise-grade insights without the need for large technical teams.

Insurance Software Solutions That Unify the Claims Lifecycle

Today’s leading Insurance Software Solutions are designed to unify the full claims lifecycle—from FNOL to subrogation—within a single, streamlined Claims Management System.

Benefits include:

- Elimination of system silos and redundant data entry

- Improved collaboration between teams and departments

- Faster, more accurate claims resolution

- Higher satisfaction among members and policyholders

By consolidating your claims operations within one intelligent platform, you unlock agility, visibility, and control across every phase of the claims journey.

Meeting the Needs of P&C Carriers with the Right Claims Management Software

Property & Casualty (P&C) insurers face unique demands across auto, liability, property, and catastrophe claims. An advanced Claims Management System built for P&C can offer:

- Flexible policy and billing integration

- Subrogation and recovery tools

- Litigation management support

- Catastrophe claim workflows

- Comprehensive audit and compliance tracking

These features help insurers manage complexity, reduce leakage, and maintain financial accuracy at scale.

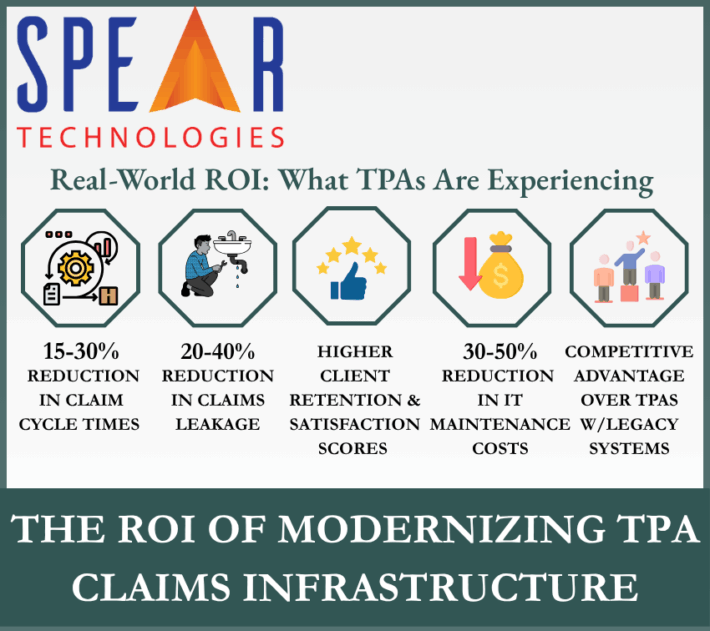

How a TPA Improved Efficiency with SpearClaims™

A leading TPA using SpearClaims™ deployed 12 built-in AI models—without any developer support. By automating invoice reading, document indexing, payment entry, and note summarization, the organization dramatically improved operational efficiency and reduced manual workload.

This is just one example of how SpearClaims™ helps TPAs and insurers use automation and Claims Management Solution intelligence to gain a competitive edge.

Experience the Power of SpearClaims™

SpearClaims™ is a future-ready Claims Management System built by industry experts on a modern low-code/no-code platform. It combines automation, analytics, and Accessible AI in a single, easy-to-use solution that’s scalable across organizations of all sizes.

- Streamline claims processing and reduce cycle time

- Improve risk assessment with intelligent analytics

- Empower business users—no coding required

Schedule a Demo today to see how SpearClaims™ can accelerate and simplify your claims process.

Request Pricing to discover how accessible and cost-effective our Claims Management Solution is for your organization.

SpearClaims™ recognized as a Technology Standout by Celent in their Claims Systems Vendors: North American P&C Insurance Report. To learn more visit www.celent.com.