The Oversight Imperative: Why Public Entities Demand More Visibility into Claims

For public entities—cities, counties, school districts, risk pools, and government agencies—claims management is no longer just an operational task; it’s a core element of fiscal responsibility, regulatory compliance, and public trust. As claim volumes rise and budgets tighten, these organizations face a growing imperative: take greater ownership of claims management oversight.

Even when partnering with Third Party Administrators (TPAs), more public entities are investing in their own claims management oversight software to regain control, improve transparency, and ensure claims dollars are being managed effectively. The goal isn’t to replace TPAs, but to gain TPA oversight to enable stronger governance and better financial outcomes.

Here’s why claims oversight is becoming mission-critical—and how modern claims management oversight solutions give public entities the visibility they need.

The Accountability Challenge in Public Sector Claims Management

Public entities are held to higher standards of accountability than private organizations. Taxpayer dollars fund claim payments. Financial waste or inefficiency can trigger audits, political fallout, or public scrutiny.

Yet many public entities rely entirely on TPAs who manage claims within their own systems. This creates serious challenges:

- Limited visibility into claim activity and outcomes

- Delayed or filtered access to key financial data

- Difficulty monitoring TPA performance and SLA compliance

- Lack of proactive identification of claims leakage or recovery opportunities

Simply put: you can’t control what you can’t see.

The Shift: Public Entities Implementing Their Own Claims Management Oversight Systems

To address these challenges, a growing number of public entities are taking control of the claims management software itself—even while keeping TPAs in place for daily administration. This hybrid approach delivers full claims oversight while retaining the operational efficiencies of outsourcing.

By investing in modern claims management oversight systems, public entities can:

- Own the claims data

- Apply workflows and reporting

- Monitor TPA performance in real-time

- Leverage advanced analytics and AI-powered automation

- Mitigate financial leakage and optimize recoveries

Key Benefits of TPA Oversight Solutions for Public Entities

1. Transparency and Data Ownership

With your own claims management oversight software, you gain immediate, unrestricted access to every claim file, reserve change, payment, note, and document. Eliminating the delay brought about by periodic extracts or custom reports.

This level of transparency allows risk managers, finance officers, and auditors to proactively monitor:

- Claim progress and outcomes

- Reserve accuracy

- Payment appropriateness

- Recovery activity

2. Real-Time Vendor Oversight and SLA Compliance

A modern claims management oversight solution gives you visibility into your TPA’s performance:

- Are adjusters following prescribed workflows?

- Are claims being triaged and escalated appropriately?

- Are payments being issued timely and accurately?

- Are subrogation and recovery opportunities actively pursued?

By establishing vendor performance dashboards and SLA tracking, public entities move from passive to active vendor management.

3. Custom Workflows and Escalation Rules

Using configurable, low-code claims automation software, public entities can build customized business rules that reflect:

- Local regulations

- Board policies

- Budget thresholds

- Compliance mandates

The TPA works inside your system, following your rules—not a one-size-fits-all process dictated by the vendor.

4. Claims Leakage Prevention Solutions to Protect Budgets

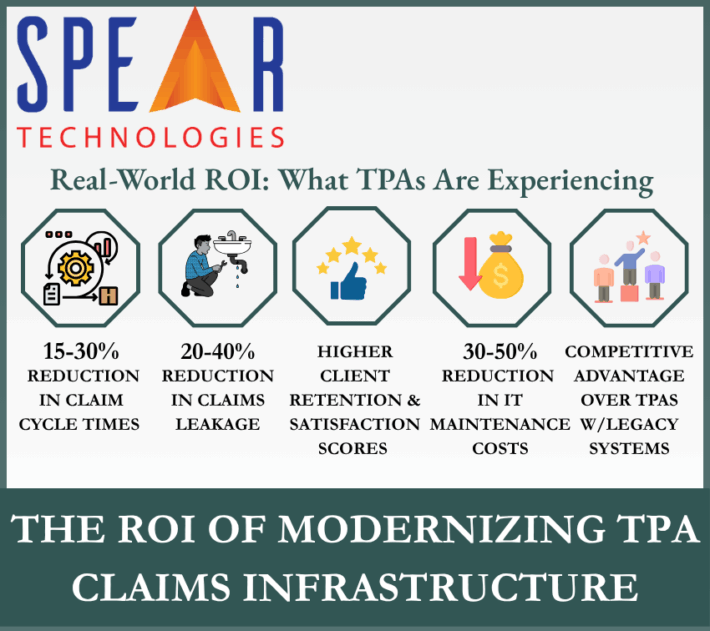

Every dollar lost to payment errors, missed subrogation, or over-reserving directly impacts public budgets. Modern claims leakage prevention solutions use AI and advanced analytics to automatically flag:

- Duplicate or erroneous payments

- Over-reserving trends

- Delayed settlements

- Missed recovery opportunities

This helps public entities protect taxpayer funds and ensure claims dollars are spent wisely.

5.Centralized Reporting Across All Claims Programs

Many public entities manage multiple programs—workers’ compensation, liability, property, auto, and more—often across multiple TPAs or departments. Claims management oversight software unifies data across programs, providing:

- Consolidated financial reporting

- Cross-program analytics

- Compliance and audit readiness

- Budget forecasting support

When Should Public Entities Consider TPA Oversight Software?

- When multiple TPAs or departments are managing claims

- When audit or compliance pressures require stronger oversight

- When financial leakage and reserve creep need tighter control

- When leadership demands better reporting and transparency

- When vendor management requires real-time SLA tracking

What to Look for in Claims Management Oversight Systems

Not all claims management software platforms are designed for public entities. Look for a solution that offers:

- Low-code/no-code configuration for business-user flexibility

- Built-in claims automation software to streamline intake, triage, and processing

- AI-powered claims leakage prevention solutions to identify errors proactively

- Real-time dashboards for SLA tracking and vendor oversight

- Seamless integration with finance, legal, HR, and ERP systems

- Strong security layer architecture and audit trails to meet public sector compliance standards – particularly important for compliance when utilizing multiple TPAs to cover different lines, ensuring that a TPA can only see the claims to which they have been assigned.

Outcome: Smarter Claims Governance, Stronger Public Accountability

By owning the claims management oversight system, public entities:

- Gain real-time visibility into all claim activity

- Improve financial accuracy and prevent leakage

- Strengthen TPA accountability and performance

- Deliver better reporting to boards, leadership, and auditors

- Protect public resources and maintain public trust

Most importantly, they move from passive claim monitoring to active claims management oversight—without increasing staff or taking on the day-to-day claims administration work.

Final Thought: TPA Oversight Is No Longer Optional

In the public sector, accountability is everything. Investing in claims management oversight solutions allows public entities to maintain strong TPA partnerships while taking control of the data, processes, and financial outcomes that matter most.

You don’t have to do the work—but you do need to own the system.

SpearClaims™: Claims Management Oversight Software Built for Public Entities

Schedule a Demo to see first-hand how SpearClaims™ will empower your organization to regain visibility, control, and confidence in your claims programs. Built by industry experts on a modern low-code/no-code platform, SpearClaims™ is a future-ready claims management software solution that combines next-generation AI and analytics to eliminate inefficiencies, prevent claims leakage, and optimize every stage of the claims lifecycle.

To discover how Spear’s solutions are accessible to organizations of all sizes, Request Pricing.